The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Energy Transfer Equity, L.P. (NYSE:ETE).

Is Energy Transfer Equity, L.P. (NYSE:ETE) a splendid stock to buy now? The best stock pickers are taking a bullish view. The number of long hedge fund positions increased by 6 lately. Our calculations also showed that ETE isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are several indicators shareholders put to use to analyze stocks. A duo of the best indicators are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the best hedge fund managers can outperform the S&P 500 by a healthy amount (see the details here).

We’re going to take a peek at the latest hedge fund action regarding Energy Transfer Equity, L.P. (NYSE:ETE).

What does the smart money think about Energy Transfer Equity, L.P. (NYSE:ETE)?

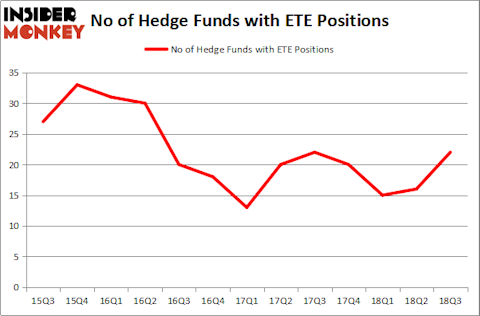

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards ETE over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Energy Transfer Equity, L.P. (NYSE:ETE) was held by Point72 Asset Management, which reported holding $81.1 million worth of stock at the end of September. It was followed by Appaloosa Management LP with a $76.2 million position. Other investors bullish on the company included Renaissance Technologies, Angelo Gordon & Co, and Omega Advisors.

Now, key hedge funds have jumped into Energy Transfer Equity, L.P. (NYSE:ETE) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the biggest call position in Energy Transfer Equity, L.P. (NYSE:ETE). Balyasny Asset Management had $26.3 million invested in the company at the end of the quarter. Matthew Knauer and Mina Faltas’s Nokota Management also initiated a $20.4 million position during the quarter. The following funds were also among the new ETE investors: Alan Fournier’s Pennant Capital Management, Alec Litowitz and Ross Laser’s Magnetar Capital, and Ken Griffin’s Citadel Investment Group.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Energy Transfer Equity, L.P. (NYSE:ETE) but similarly valued. These stocks are ABIOMED, Inc. (NASDAQ:ABMD), Freeport-McMoRan Inc. (NYSE:FCX), Global Payments Inc (NYSE:GPN), and FleetCor Technologies, Inc. (NYSE:FLT). All of these stocks’ market caps resemble ETE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ABMD | 22 | 1750748 | -2 |

| FCX | 47 | 2251355 | 5 |

| GPN | 26 | 443182 | 4 |

| FLT | 37 | 1371542 | 4 |

| Average | 33 | 1454207 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $1.45 billion. That figure was $400 million in ETE’s case. Freeport-McMoRan Inc. (NYSE:FCX) is the most popular stock in this table. On the other hand ABIOMED, Inc. (NASDAQ:ABMD) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Energy Transfer Equity, L.P. (NYSE:ETE) is even less popular than ABMD. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.