The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Dermira Inc (NASDAQ:DERM) from the perspective of those successful funds.

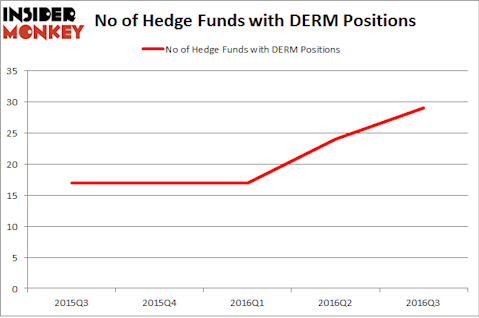

Dermira Inc (NASDAQ:DERM) has seen an increase in activity from the world’s largest hedge funds recently. DERM was in 29 hedge funds’ portfolios at the end of September. There were 24 hedge funds in our database with DERM holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as CVR Energy, Inc. (NYSE:CVI), Western Refining Logistics LP(NYSE:WNRL), and iRobot Corporation (NASDAQ:IRBT) to gather more data points.

Follow Dermira Inc. (NASDAQ:DERM)

Follow Dermira Inc. (NASDAQ:DERM)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Andrey_Popov/Shutterstock.com

With all of this in mind, let’s take a glance at the new action surrounding Dermira Inc (NASDAQ:DERM).

What does the smart money think about Dermira Inc (NASDAQ:DERM)?

At Q3’s end, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, up 21% from the previous quarter. The graph below displays the number of hedge funds with bullish position in DERM over the last 5 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, venBio Select Advisor, led by Behzad Aghazadeh, holds the number one position in Dermira Inc (NASDAQ:DERM).The fund reportedly has a $27.3 million position in the stock, comprising 4.8% of its 13F portfolio. The second largest stake is held by Balyasny Asset Management, led by Dmitry Balyasny, which holds a $25.3 million position; 0.1% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism encompass Jeffrey Jay and David Kroin’s Great Point Partners, Oleg Nodelman’s EcoR1 Capital and Samuel Isaly’s OrbiMed Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. OrbiMed Advisors, led by Samuel Isaly, established the most valuable position in Dermira Inc (NASDAQ:DERM). According to regulatory filings, the fund had $14.4 million invested in the company at the end of the quarter. Paul Sinclair’s Blue Jay Capital Management also made a $9.3 million investment in the stock during the quarter. The other funds with brand new DERM positions are Barry Rosenstein’s JANA Partners, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Drew Cupps’s Cupps Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Dermira Inc (NASDAQ:DERM) but similarly valued. We will take a look at CVR Energy, Inc. (NYSE:CVI), Western Refining Logistics LP(NYSE:WNRL), iRobot Corporation (NASDAQ:IRBT), and COMSCORE, Inc. (NASDAQ:SCOR). This group of stocks’ market values match DERM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVI | 13 | 1012103 | -3 |

| WNRL | 7 | 89609 | 2 |

| IRBT | 12 | 61856 | -3 |

| SCOR | 14 | 234447 | -9 |

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $350 million. That figure was $205 million in DERM’s case. COMSCORE, Inc. (NASDAQ:SCOR) is the most popular stock in this table. On the other hand Western Refining Logistics LP(NYSE:WNRL) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Dermira Inc (NASDAQ:DERM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Suggested Articles:

Most Expensive Luggage Bags and Brands

Top Snack Foods Consumed In America

Best Team Building Problem Solving Activities

Disclosure: None