In this article we will check out the progression of hedge fund sentiment towards Central Garden & Pet Co (NASDAQ:CENT) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

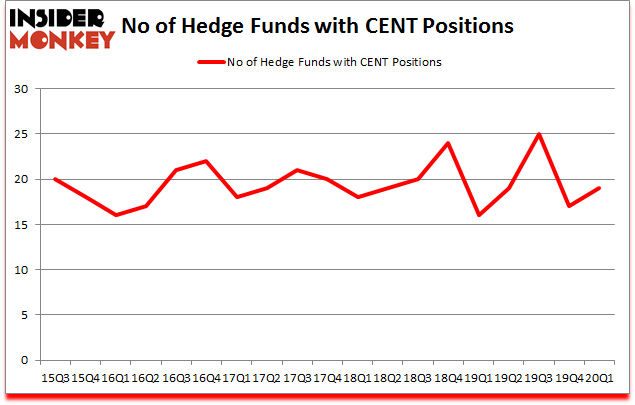

Central Garden & Pet Co (NASDAQ:CENT) was in 19 hedge funds’ portfolios at the end of March. CENT has experienced an increase in hedge fund interest in recent months. There were 17 hedge funds in our database with CENT positions at the end of the previous quarter. Our calculations also showed that CENT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are viewed as underperforming, outdated investment vehicles of yesteryear. While there are greater than 8000 funds trading at the moment, Our researchers choose to focus on the leaders of this club, about 850 funds. Most estimates calculate that this group of people command the majority of the smart money’s total capital, and by keeping track of their finest investments, Insider Monkey has unsheathed several investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to view the recent hedge fund action encompassing Central Garden & Pet Co (NASDAQ:CENT).

How are hedge funds trading Central Garden & Pet Co (NASDAQ:CENT)?

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CENT over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Armistice Capital was the largest shareholder of Central Garden & Pet Co (NASDAQ:CENT), with a stake worth $38.4 million reported as of the end of September. Trailing Armistice Capital was Renaissance Technologies, which amassed a stake valued at $29.8 million. Renaissance Technologies, D E Shaw, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Armistice Capital allocated the biggest weight to Central Garden & Pet Co (NASDAQ:CENT), around 2.37% of its 13F portfolio. Quantinno Capital is also relatively very bullish on the stock, earmarking 0.41 percent of its 13F equity portfolio to CENT.

As aggregate interest increased, specific money managers have been driving this bullishness. Echo Street Capital Management, managed by Greg Poole, established the biggest position in Central Garden & Pet Co (NASDAQ:CENT). Echo Street Capital Management had $1.5 million invested in the company at the end of the quarter. Hoon Kim’s Quantinno Capital also initiated a $0.7 million position during the quarter. The other funds with brand new CENT positions are Dmitry Balyasny’s Balyasny Asset Management, Paul Tudor Jones’s Tudor Investment Corp, and Philippe Laffont’s Coatue Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Central Garden & Pet Co (NASDAQ:CENT) but similarly valued. These stocks are Heartland Express, Inc. (NASDAQ:HTLD), Hailiang Education Group Inc. (NASDAQ:HLG), FS KKR Capital Corp. (NASDAQ:FSK), and Cantel Medical Corp. (NYSE:CMD). All of these stocks’ market caps resemble CENT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HTLD | 11 | 28377 | -3 |

| HLG | 2 | 7859 | -1 |

| FSK | 19 | 84925 | -9 |

| CMD | 17 | 88691 | 6 |

| Average | 12.25 | 52463 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $109 million in CENT’s case. FS KKR Capital Corp. (NASDAQ:FSK) is the most popular stock in this table. On the other hand Hailiang Education Group Inc. (NASDAQ:HLG) is the least popular one with only 2 bullish hedge fund positions. Central Garden & Pet Co (NASDAQ:CENT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.4% in 2020 through June 22nd but still beat the market by 15.9 percentage points. Hedge funds were also right about betting on CENT, though not to the same extent, as the stock returned 22.6% during the first two months and twenty two days of the second quarter and outperformed the market as well.

Follow Central Garden & Pet Co (NASDAQ:CENT)

Follow Central Garden & Pet Co (NASDAQ:CENT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.