A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by nearly 7 percentage points during the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of Booking Holdings Inc. (NASDAQ:BKNG) during the quarter.

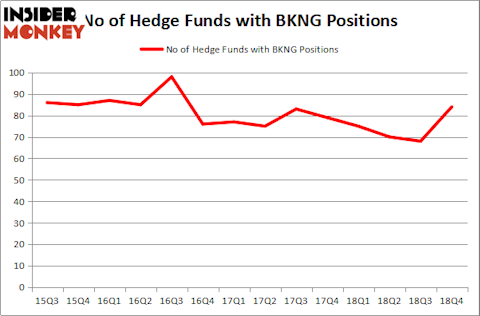

Is Booking Holdings Inc. (NASDAQ:BKNG) a first-rate investment now? Prominent investors are buying. The number of long hedge fund positions went up by 16 recently. Our calculations also showed that BKNG is among the 30 most popular stocks among hedge funds, ranking 17th. BKNG was in 84 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 68 hedge funds in our database with BKNG positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to analyze the key hedge fund action regarding Booking Holdings Inc. (NASDAQ:BKNG).

What does the smart money think about Booking Holdings Inc. (NASDAQ:BKNG)?

At Q4’s end, a total of 84 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 24% from the previous quarter. On the other hand, there were a total of 75 hedge funds with a bullish position in BKNG a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Booking Holdings Inc. (NASDAQ:BKNG) was held by Tiger Global Management LLC, which reported holding $777.2 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $760.3 million position. Other investors bullish on the company included D E Shaw, Lone Pine Capital, and AQR Capital Management.

As one would reasonably expect, key hedge funds have jumped into Booking Holdings Inc. (NASDAQ:BKNG) headfirst. Lone Pine Capital, managed by Stephen Mandel, established the most valuable position in Booking Holdings Inc. (NASDAQ:BKNG). Lone Pine Capital had $608.9 million invested in the company at the end of the quarter. Stuart Powers’s Hengistbury Investment Partners also made a $91.1 million investment in the stock during the quarter. The other funds with brand new BKNG positions are Ken Griffin’s Citadel Investment Group, and Ike Kier and Ilya Zaides’s KG Funds Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Booking Holdings Inc. (NASDAQ:BKNG) but similarly valued. These stocks are Caterpillar Inc. (NYSE:CAT), Lockheed Martin Corporation (NYSE:LMT), Lowe’s Companies, Inc. (NYSE:LOW), and U.S. Bancorp (NYSE:USB). This group of stocks’ market valuations match BKNG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAT | 60 | 3130061 | -3 |

| LMT | 42 | 1269393 | 6 |

| LOW | 53 | 4173120 | -4 |

| USB | 41 | 6538818 | 2 |

| Average | 49 | 3777848 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49 hedge funds with bullish positions and the average amount invested in these stocks was $3778 million. That figure was $6437 million in BKNG’s case. Caterpillar Inc. (NYSE:CAT) is the most popular stock in this table. On the other hand U.S. Bancorp (NYSE:USB) is the least popular one with only 41 bullish hedge fund positions. Compared to these stocks Booking Holdings Inc. (NASDAQ:BKNG) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately BKNG wasn’t in this group. Hedge funds that bet on BKNG were disappointed as the stock returned 1.7% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.