Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in October due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 30 S&P 500 stocks among hedge funds at the end of September 2018 returned an average of 6.7% through November 15th whereas the S&P 500 Index ETF gained only 2.6% during the same period. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at American Airlines Group Inc (NASDAQ:AAL) from the perspective of those elite funds.

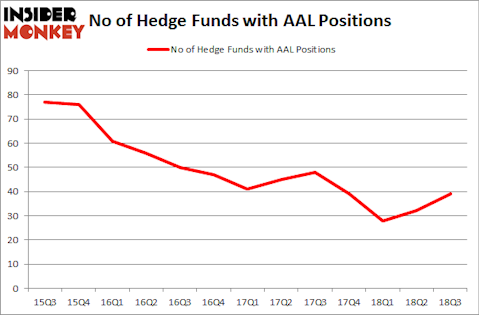

American Airlines Group Inc (NASDAQ:AAL) has experienced an increase in support from the world’s most elite money managers lately. AAL was in 39 hedge funds’ portfolios at the end of September. There were 32 hedge funds in our database with AAL positions at the end of the previous quarter. Our calculations also showed that AAL isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are many methods investors can use to analyze publicly traded companies. Some of the best methods are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top fund managers can trounce their index-focused peers by a solid amount (see the details here).

Warren Buffett of Berkshire Hathaway

Let’s take a glance at the key hedge fund action surrounding American Airlines Group Inc (NASDAQ:AAL).

Hedge fund activity in American Airlines Group Inc (NASDAQ:AAL)

At the end of the third quarter, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AAL over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

The largest stake in American Airlines Group Inc (NASDAQ:AAL) was held by Berkshire Hathaway, which reported holding $1806.1 million worth of stock at the end of September. It was followed by Lansdowne Partners with a $305.5 million position. Other investors bullish on the company included Adage Capital Management, Masters Capital Management, and Citadel Investment Group.

Now, key money managers were breaking ground themselves. Interval Partners, managed by Gregg Moskowitz, assembled the biggest position in American Airlines Group Inc (NASDAQ:AAL). Interval Partners had $35.1 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also initiated a $33.4 million position during the quarter. The following funds were also among the new AAL investors: Dmitry Balyasny’s Balyasny Asset Management, Hari Hariharan’s NWI Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as American Airlines Group Inc (NASDAQ:AAL) but similarly valued. We will take a look at Shinhan Financial Group Co., Ltd. (NYSE:SHG), Boston Properties, Inc. (NYSE:BXP), Mylan N.V. (NASDAQ:MYL), and Check Point Software Technologies Ltd. (NASDAQ:CHKP). This group of stocks’ market caps are closest to AAL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHG | 2 | 7305 | -1 |

| BXP | 17 | 348406 | 6 |

| MYL | 39 | 3249890 | -1 |

| CHKP | 26 | 813840 | 4 |

| Average | 21 | 1104860 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $1.10 billion. That figure was $2.80 billion in AAL’s case. Mylan N.V. (NASDAQ:MYL) is the most popular stock in this table. On the other hand Shinhan Financial Group Co., Ltd. (NYSE:SHG) is the least popular one with only 2 bullish hedge fund positions. American Airlines Group Inc (NASDAQ:AAL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MYL might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.