It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 30 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 15.1% over the last 12 months (vs. 5.6% gain for SPY), with 53% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Aldeyra Therapeutics Inc (NASDAQ:ALDX).

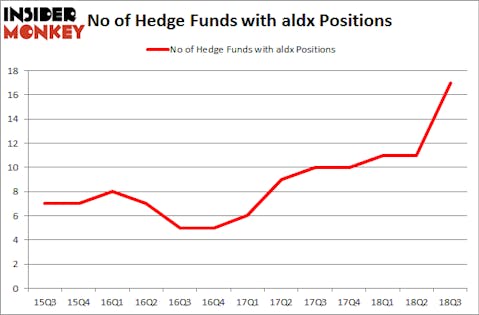

Is Aldeyra Therapeutics Inc (NASDAQ:ALDX) a superb investment today? The smart money is getting more optimistic. The number of long hedge fund bets went up by 6 lately. Our calculations also showed that aldx isn’t among the 30 most popular stocks among hedge funds. ALDX was in 17 hedge funds’ portfolios at the end of September. There were 11 hedge funds in our database with ALDX positions at the end of the previous quarter.

According to most shareholders, hedge funds are viewed as slow, outdated investment tools of yesteryear. While there are more than 8,000 funds trading at the moment, We look at the masters of this group, around 700 funds. These hedge fund managers administer most of the hedge fund industry’s total asset base, and by paying attention to their finest stock picks, Insider Monkey has unearthed many investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s analyze the latest hedge fund action regarding Aldeyra Therapeutics Inc (NASDAQ:ALDX).

How have hedgies been trading Aldeyra Therapeutics Inc (NASDAQ:ALDX)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 55% from one quarter earlier. By comparison, 10 hedge funds held shares or bullish call options in ALDX heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Perceptive Advisors was the largest shareholder of Aldeyra Therapeutics Inc (NASDAQ:ALDX), with a stake worth $42.6 million reported as of the end of September. Trailing Perceptive Advisors was 683 Capital Partners, which amassed a stake valued at $18.6 million. Millennium Management, Mangrove Partners, and Knoll Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers were breaking ground themselves. Laurion Capital Management, managed by Benjamin A. Smith, established the most valuable position in Aldeyra Therapeutics Inc (NASDAQ:ALDX). Laurion Capital Management had $2.8 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $1.7 million position during the quarter. The following funds were also among the new ALDX investors: Panayotis Takis Sparaggis’s Alkeon Capital Management, Louis Bacon’s Moore Global Investments, and Vishal Saluja and Pham Quang’s Endurant Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Aldeyra Therapeutics Inc (NASDAQ:ALDX) but similarly valued. These stocks are AudioCodes Ltd. (NASDAQ:AUDC), BayCom Corp (NASDAQ:BCML), Gain Capital Holdings Inc (NYSE:GCAP), and PDF Solutions, Inc. (NASDAQ:PDFS). This group of stocks’ market values are similar to ALDX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AUDC | 9 | 24638 | 4 |

| BCML | 5 | 28639 | -1 |

| GCAP | 11 | 28642 | 0 |

| PDFS | 10 | 17524 | 1 |

| Average | 8.75 | 24861 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $105 million in ALDX’s case. Gain Capital Holdings Inc (NYSE:GCAP) is the most popular stock in this table. On the other hand BayCom Corp (NASDAQ:BCML) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Aldeyra Therapeutics Inc (NASDAQ:ALDX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.