Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example the Standard and Poor’s 500 Total Return Index ETFs returned 27.5% (including dividend payments) through the end of November. Conversely, hedge funds’ top 20 large-cap stock picks generated a return of nearly 37.4% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like MakeMyTrip Limited (NASDAQ:MMYT).

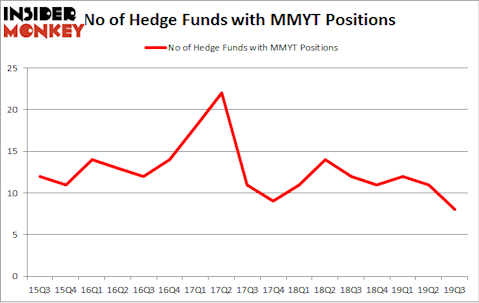

Is MakeMyTrip Limited (NASDAQ:MMYT) an attractive investment now? Hedge funds are getting less bullish. The number of bullish hedge fund bets decreased by 3 lately. Our calculations also showed that MMYT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a lot of formulas market participants use to assess stocks. A duo of the best formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top investment managers can beat the S&P 500 by a healthy margin (see the details here).

Daniel Gold of QVT Financial

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the latest hedge fund action encompassing MakeMyTrip Limited (NASDAQ:MMYT).

How are hedge funds trading MakeMyTrip Limited (NASDAQ:MMYT)?

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -27% from one quarter earlier. On the other hand, there were a total of 12 hedge funds with a bullish position in MMYT a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, GMT Capital was the largest shareholder of MakeMyTrip Limited (NASDAQ:MMYT), with a stake worth $35.1 million reported as of the end of September. Trailing GMT Capital was QVT Financial, which amassed a stake valued at $14.1 million. Fisher Asset Management, Renaissance Technologies, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position QVT Financial allocated the biggest weight to MakeMyTrip Limited (NASDAQ:MMYT), around 2.91% of its 13F portfolio. GMT Capital is also relatively very bullish on the stock, setting aside 1.29 percent of its 13F equity portfolio to MMYT.

Because MakeMyTrip Limited (NASDAQ:MMYT) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of hedge funds that slashed their full holdings last quarter. Intriguingly, Israel Englander’s Millennium Management dropped the biggest stake of the “upper crust” of funds tracked by Insider Monkey, valued at close to $3.1 million in call options, and Frank Slattery’s Symmetry Peak Management was right behind this move, as the fund cut about $1.5 million worth. These moves are important to note, as total hedge fund interest was cut by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as MakeMyTrip Limited (NASDAQ:MMYT) but similarly valued. We will take a look at WSFS Financial Corporation (NASDAQ:WSFS), LivePerson, Inc. (NASDAQ:LPSN), Crescent Point Energy Corp (NYSE:CPG), and Anixter International Inc. (NYSE:AXE). This group of stocks’ market valuations resemble MMYT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WSFS | 10 | 168789 | -5 |

| LPSN | 16 | 190487 | -1 |

| CPG | 10 | 64227 | -2 |

| AXE | 18 | 293397 | -2 |

| Average | 13.5 | 179225 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $179 million. That figure was $63 million in MMYT’s case. Anixter International Inc. (NYSE:AXE) is the most popular stock in this table. On the other hand WSFS Financial Corporation (NASDAQ:WSFS) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks MakeMyTrip Limited (NASDAQ:MMYT) is even less popular than WSFS. Hedge funds clearly dropped the ball on MMYT as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on MMYT as the stock returned 14.7% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.