These factors are important, but as investors we also need to weigh the trade-off between the current state of the company and price too. The broader thesis outlined in our previous letters remains largely intact.

Simplistically, the company is on track to do ~$70BN in sales this year, and $100BN in 2020. Electronics and appliances make up ~75% of JD’s revenue mix, which due to the nature of the categories carry lower-margins vs. say apparel or general merchandise (see below for Alibaba’s TMall take-rates, as an example). If JD can simply maintain a 2 – 3% margin on this category, the profits by 2020 would reach at least $2BN. This would equate to a 16x EV/EBIT multiple, growing at 20% y/y.

Additional levers, such as category expansion into FMCG (similar margins, smaller order sizes, but higher order frequency / volume) or general merchandise (higher margins, smaller order sizes) would give the stock considerable upside optionality. This gets even more attractive if we back out the logistics and finance divisions, which have both raised external funding and may be individually listed at some point. Excluding these divisions, with JD’s stake worth ~$24BN (at the last round valuations), the core retail part of the business comes down to just a ~5x multiple.

Rest assured I’m watching these value-drivers closely, as competitive advantages change due to the intense competition in the industry. I promise to keep our Partners updated with any new developments.”

Let’s take a glance at what other smart money investors think about JD.com, Inc. (NASDAQ:JD)?

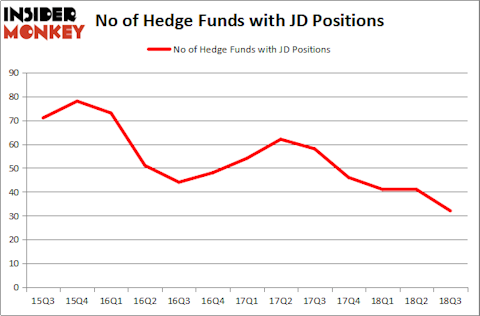

Heading into the fourth quarter of 2018, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of -22% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards JD over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chase Coleman’s Tiger Global Management LLC has the number one position in JD.com, Inc. (NASDAQ:JD), worth close to $1.32 billion, amounting to 6.2% of its total 13F portfolio. The second most bullish fund manager is Hillhouse Capital Management, managed by Lei Zhang, which holds a $553.4 million position; the fund has 14.7% of its 13F portfolio invested in the stock. Some other peers with similar optimism consist of Ken Fisher’s Fisher Asset Management, Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC and Panayotis Takis Sparaggis’s Alkeon Capital Management.

Judging by the fact that JD.com, Inc. (NASDAQ:JD) has experienced a decline in interest from the aggregate hedge fund industry, we can see that there was a specific group of money managers that elected to cut their positions entirely heading into Q3. It’s worth mentioning that Philippe Laffont’s Coatue Management sold off the largest investment of all the hedgies monitored by Insider Monkey, comprising an estimated $492.4 million in stock, and William B. Gray’s Orbis Investment Management was right behind this move, as the fund dropped about $373.5 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 9 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to JD.com, Inc. (NASDAQ:JD). These stocks are BB&T Corporation (NYSE:BBT), Eaton Corporation plc (NYSE:ETN), Aon plc (NYSE:AON), and Baker Hughes, a GE company (NYSE:BHGE). All of these stocks’ market caps are similar to JD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBT | 20 | 118410 | -1 |

| ETN | 38 | 965450 | 8 |

| AON | 30 | 3070022 | -7 |

| BHGE | 27 | 711079 | 7 |

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1.22 billion. That figure was $2.97 billion in JD’s case. Eaton Corporation plc (NYSE:ETN) is the most popular stock in this table. On the other hand BB&T Corporation (NYSE:BBT) is the least popular one with only 20 bullish hedge fund positions. JD.com, Inc. (NASDAQ:JD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ETN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.