Is Furniture Brands International, Inc. (NYSE:FBN) a buy here? Investors who are in the know are getting less bullish. The number of bullish hedge fund bets went down by 1 in recent months.

Equally as beneficial, optimistic insider trading activity is a second way to break down the financial markets. As the old adage goes: there are a number of motivations for an insider to downsize shares of his or her company, but only one, very obvious reason why they would initiate a purchase. Plenty of academic studies have demonstrated the valuable potential of this strategy if piggybackers know where to look (learn more here).

Keeping this in mind, it’s important to take a glance at the latest action regarding Furniture Brands International, Inc. (NYSE:FBN).

What have hedge funds been doing with Furniture Brands International, Inc. (NYSE:FBN)?

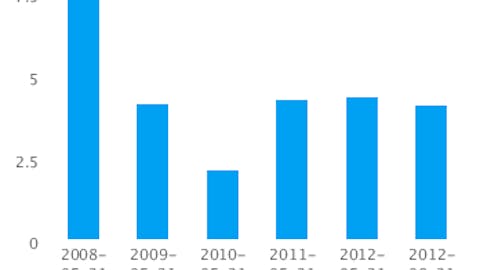

Heading into 2013, a total of 8 of the hedge funds we track were long in this stock, a change of -11% from the third quarter. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes significantly.

According to our comprehensive database, Chuck Royce’s Royce & Associates had the biggest position in Furniture Brands International, Inc. (NYSE:FBN), worth close to $4.2 million, accounting for less than 0.1%% of its total 13F portfolio. On Royce & Associates’s heels is Oaktree Capital Management, managed by Howard Marks, which held a $2.8 million position; 0.1% of its 13F portfolio is allocated to the company. Other hedge funds that are bullish include Jim Simons’s Renaissance Technologies, Phil Frohlich’s Prescott Group Capital Management and D. E. Shaw’s D E Shaw.

Since Furniture Brands International, Inc. (NYSE:FBN) has experienced falling interest from the entirety of the hedge funds we track, it’s safe to say that there were a few hedgies who sold off their full holdings heading into 2013. Intriguingly, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners dumped the biggest investment of the “upper crust” of funds we watch, worth an estimated $0.1 million in stock.. Cliff Asness’s fund, AQR Capital Management, also dumped its stock, about $0.1 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 1 funds heading into 2013.

How are insiders trading Furniture Brands International, Inc. (NYSE:FBN)?

Bullish insider trading is most useful when the company in question has experienced transactions within the past 180 days. Over the last 180-day time frame, Furniture Brands International, Inc. (NYSE:FBN) has experienced 1 unique insiders buying, and zero insider sales (see the details of insider trades here).

Let’s also review hedge fund and insider activity in other stocks similar to Furniture Brands International, Inc. (NYSE:FBN). These stocks are Flexsteel Industries, Inc. (NASDAQ:FLXS), Bassett Furniture Industries Inc. (NASDAQ:BSET), Hooker Furniture Corporation (NASDAQ:HOFT), Natuzzi, S.p.A (ADR) (NYSE:NTZ), and Stanley Furniture Co. (NASDAQ:STLY). All of these stocks are in the home furnishings & fixtures industry and their market caps are closest to FBN’s market cap.

| Company Name | # of Hedge Funds | # of Insiders Buying | # of Insiders Selling |

| Flexsteel Industries, Inc. (NASDAQ:FLXS) | 3 | 2 | 2 |

| Bassett Furniture Industries Inc. (NASDAQ:BSET) | 2 | 3 | 3 |

| Hooker Furniture Corporation (NASDAQ:HOFT) | 4 | 0 | 2 |

| Natuzzi, S.p.A (ADR) (NYSE:NTZ) | 2 | 0 | 0 |

| Stanley Furniture Co. (NASDAQ:STLY) | 3 | 3 | 0 |

With the returns shown by our research, everyday investors should always monitor hedge fund and insider trading sentiment, and Furniture Brands International, Inc. (NYSE:FBN) shareholders fit into this picture quite nicely.