“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Carter’s, Inc. (NYSE:CRI) in order to identify whether reputable and successful top money managers continue to believe in its potential.

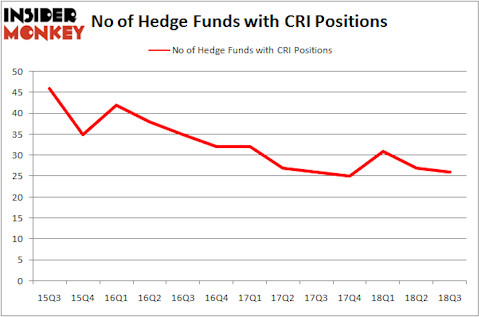

Carter’s, Inc. (NYSE:CRI) investors should pay attention to a decrease in support from the world’s most elite money managers lately. Our calculations also showed that CRI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action encompassing Carter’s, Inc. (NYSE:CRI).

What have hedge funds been doing with Carter’s, Inc. (NYSE:CRI)?

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from one quarter earlier. By comparison, 25 hedge funds held shares or bullish call options in CRI heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Israel Englander’s Millennium Management has the biggest position in Carter’s, Inc. (NYSE:CRI), worth close to $107.2 million, amounting to 0.1% of its total 13F portfolio. On Millennium Management’s heels is Cliff Asness of AQR Capital Management, with a $69 million position; 0.1% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions comprise David Gallo’s Valinor Management LLC, Ric Dillon’s Diamond Hill Capital and Bernard Horn’s Polaris Capital Management.

Judging by the fact that Carter’s, Inc. (NYSE:CRI) has faced falling interest from the entirety of the hedge funds we track, we can see that there is a sect of funds who sold off their positions entirely by the end of the third quarter. Intriguingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the largest position of the 700 funds monitored by Insider Monkey, worth about $68.8 million in stock, and Gregg Moskowitz’s Interval Partners was right behind this move, as the fund cut about $38 million worth. These transactions are important to note, as total hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Carter’s, Inc. (NYSE:CRI). We will take a look at Nu Skin Enterprises, Inc. (NYSE:NUS), Umpqua Holdings Corp (NASDAQ:UMPQ), IBERIABANK Corporation (NASDAQ:IBKC), and Jabil Inc. (NYSE:JBL). This group of stocks’ market valuations resemble CRI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NUS | 18 | 300966 | 0 |

| UMPQ | 20 | 302634 | 3 |

| IBKC | 21 | 387072 | 5 |

| JBL | 22 | 298289 | 1 |

| Average | 20.25 | 322240 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $322 million. That figure was $484 million in CRI’s case. Jabil Inc. (NYSE:JBL) is the most popular stock in this table. On the other hand Nu Skin Enterprises, Inc. (NYSE:NUS) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Carter’s, Inc. (NYSE:CRI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.