Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

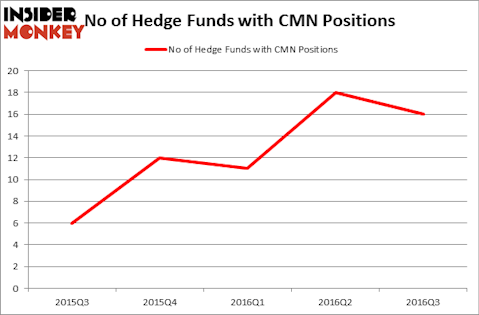

Cantel Medical Corp. (NYSE:CMN) investors should pay attention to a decrease in activity from the world’s largest hedge funds of late. There were 16 hedge funds in our database with CMN holdings at the end of September, compared to 18 funds at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Catalent Inc (NYSE:CTLT), EnLink Midstream LLC (NYSE:ENLC), and Helen of Troy Limited (NASDAQ:HELE) to gather more data points.

Follow Cantel Medical Corp (NYSE:CMD)

Follow Cantel Medical Corp (NYSE:CMD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Tyler Olson/Shutterstock.com

Keeping this in mind, let’s take a peek at the latest action surrounding Cantel Medical Corp. (NYSE:CMN).

How are hedge funds trading Cantel Medical Corp. (NYSE:CMN)?

At the end of the third quarter, 16 funds tracked by Insider Monkey were bullish on Cantel Medical Corp, which represents a drop of 11% over the quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in CMN at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Mark N. Diker’s Diker Management holds the number one position in Cantel Medical Corp. (NYSE:CMN) which has a $143.6 million position in the stock, comprising 51.2% of its 13F portfolio. On Diker Management’s heels is Mario Gabelli’s GAMCO Investors which holds a $12.5 million position. Remaining hedge funds and institutional investors that are bullish comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Louis Navellier’s Navellier & Associates, and Ken Griffin’s Citadel Investment Group. We should note that Diker Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.