The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 866 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of March 31st, 2020. In this article we are going to take a look at smart money sentiment towards AgeX Therapeutics, Inc. (NYSE:AGE).

Hedge fund interest in AgeX Therapeutics, Inc. (NYSE:AGE) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that AGE isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). At the end of this article we will also compare AGE to other stocks including Research Solutions, Inc (NASDAQ:RSSS), Cyren Ltd (NASDAQ:CYRN), and Inhibikase Therapeutics, Inc. (NASDAQ:IKT) to get a better sense of its popularity.

In today’s marketplace there are many gauges market participants employ to analyze their holdings. A duo of the less known gauges are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the best investment managers can outperform the broader indices by a healthy margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Israel Englander of Millennium Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, an activist hedge fund wants to buy this $26 biotech stock for $50. So, we recommended a long position to our monthly premium newsletter subscribers. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s analyze the fresh hedge fund action surrounding AgeX Therapeutics, Inc. (NYSE:AGE).

Do Hedge Funds Think AGE Is A Good Stock To Buy Now?

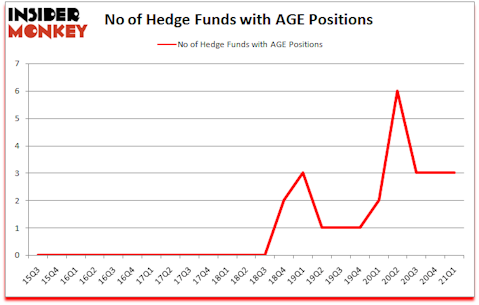

At first quarter’s end, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 2 hedge funds with a bullish position in AGE a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in AgeX Therapeutics, Inc. (NYSE:AGE) was held by Broadwood Capital, which reported holding $4.9 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $0.5 million position. The only other hedge fund that is bullish on the company was Millennium Management.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as AgeX Therapeutics, Inc. (NYSE:AGE) but similarly valued. These stocks are Research Solutions, Inc (NASDAQ:RSSS), Cyren Ltd (NASDAQ:CYRN), Inhibikase Therapeutics, Inc. (NASDAQ:IKT), ALJ Regional Holdings, Inc. (NASDAQ:ALJJ), Socket Mobile, Inc. (NASDAQ:SCKT), Birks Group Inc. (NYSE:BGI), and RF Industries, Ltd. (NASDAQ:RFIL). This group of stocks’ market valuations are similar to AGE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RSSS | 2 | 3657 | -2 |

| CYRN | 3 | 1825 | 0 |

| IKT | 2 | 174 | 2 |

| ALJJ | 4 | 1384 | 2 |

| SCKT | 3 | 859 | 1 |

| BGI | 2 | 405 | 0 |

| RFIL | 2 | 4408 | -1 |

| Average | 2.6 | 1816 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.6 hedge funds with bullish positions and the average amount invested in these stocks was $2 million. That figure was $5 million in AGE’s case. ALJ Regional Holdings, Inc. (NASDAQ:ALJJ) is the most popular stock in this table. On the other hand Research Solutions, Inc (NASDAQ:RSSS) is the least popular one with only 2 bullish hedge fund positions. AgeX Therapeutics, Inc. (NYSE:AGE) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AGE is 45. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.2% in 2021 through June 11th and beat the market again by 3.3 percentage points. Unfortunately AGE wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on AGE were disappointed as the stock returned -5.6% since the end of March (through 6/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Serina Therapeutics Inc. (NYSE:SER)

Follow Serina Therapeutics Inc. (NYSE:SER)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.