While the market driven by short-term sentiment influenced by the accommodative interest rate environment in the US, virus news and stimulus spending, many smart money investors are starting to get cautious towards the current bull run since March, 2020 and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Nasdaq, Inc. (NASDAQ:NDAQ).

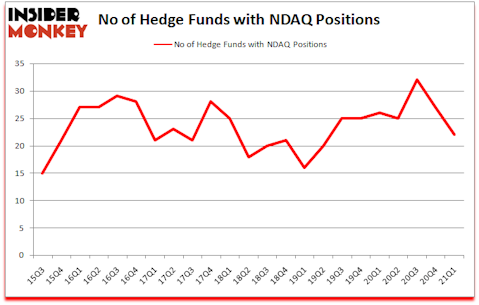

Nasdaq, Inc. (NASDAQ:NDAQ) investors should pay attention to a decrease in hedge fund interest of late. Nasdaq, Inc. (NASDAQ:NDAQ) was in 22 hedge funds’ portfolios at the end of March. The all time high for this statistic is 32. Our calculations also showed that NDAQ isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

At the moment there are many indicators stock market investors use to appraise publicly traded companies. Some of the best indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top investment managers can outclass the market by a significant margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Bruce Kovner of Caxton Associates LP

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the new hedge fund action regarding Nasdaq, Inc. (NASDAQ:NDAQ).

Do Hedge Funds Think NDAQ Is A Good Stock To Buy Now?

At the end of March, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -19% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NDAQ over the last 23 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Nasdaq, Inc. (NASDAQ:NDAQ), which was worth $45.8 million at the end of the fourth quarter. On the second spot was Two Sigma Advisors which amassed $42.4 million worth of shares. Millennium Management, Renaissance Technologies, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Full18 Capital allocated the biggest weight to Nasdaq, Inc. (NASDAQ:NDAQ), around 2.61% of its 13F portfolio. Quantamental Technologies is also relatively very bullish on the stock, setting aside 1.49 percent of its 13F equity portfolio to NDAQ.

Seeing as Nasdaq, Inc. (NASDAQ:NDAQ) has faced falling interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of fund managers who sold off their entire stakes in the first quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management sold off the largest investment of the 750 funds tracked by Insider Monkey, valued at an estimated $39.9 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund dropped about $7.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 5 funds in the first quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Nasdaq, Inc. (NASDAQ:NDAQ) but similarly valued. These stocks are The Clorox Company (NYSE:CLX), AmerisourceBergen Corporation (NYSE:ABC), ZTO Express (Cayman) Inc. (NYSE:ZTO), New Oriental Education & Technology Group Inc. (NYSE:EDU), Kansas City Southern (NYSE:KSU), Nucor Corporation (NYSE:NUE), and Franco-Nevada Corporation (NYSE:FNV). All of these stocks’ market caps match NDAQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLX | 38 | 1195544 | -1 |

| ABC | 43 | 1177164 | -4 |

| ZTO | 15 | 659779 | -2 |

| EDU | 45 | 2187946 | 2 |

| KSU | 49 | 1662353 | 0 |

| NUE | 25 | 191827 | -4 |

| FNV | 20 | 933238 | -7 |

| Average | 33.6 | 1143979 | -2.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.6 hedge funds with bullish positions and the average amount invested in these stocks was $1144 million. That figure was $236 million in NDAQ’s case. Kansas City Southern (NYSE:KSU) is the most popular stock in this table. On the other hand ZTO Express (Cayman) Inc. (NYSE:ZTO) is the least popular one with only 15 bullish hedge fund positions. Nasdaq, Inc. (NASDAQ:NDAQ) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for NDAQ is 30.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and still beat the market by 7.7 percentage points. A small number of hedge funds were also right about betting on NDAQ as the stock returned 21.5% since the end of the first quarter (through 7/16) and outperformed the market by an even larger margin.

Follow Nasdaq Inc. (NASDAQ:NDAQ)

Follow Nasdaq Inc. (NASDAQ:NDAQ)

Receive real-time insider trading and news alerts

Suggested Articles:

- Billionaire Andreas Halvorsen’s Top Stock Picks

- Top 25 Places to Visit in the US

- 10 Best Fintech Startups Investors are Flocking To

Disclosure: None. This article was originally published at Insider Monkey.