In this case, we look at rallying dividend stocks with increased pessimism from short sellers. All stocks in the list below have met the following criteria:

Market cap above $300 and rapidly growing: Share price is rallying above its 20, 50 and 200 day moving averages (MA). This is an incredibly bullish technical indicator that says the stock is running strong, and may have some more upward momentum to price in.

Dividend yields between 3%-8%, a relatively sustainable high yield range.

To find signs their rally may be coming to an end, or even reversing, we look to short sellers for a healthy dose of pessimism. Short sellers benefit when share price falls. Their collectively increased short positions on a stock indicates a belief that there is more downside than upside to price in. For this list we screen for increased shorting month over month.

For a similar list, check out “Institutions Are Buying these 9 Rallying Stocks Offering Sweet Dividends.”

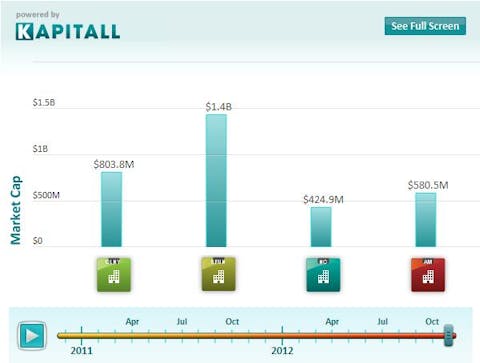

1. Colony Financial, Inc. (CLNY, Earnings, Analysts, Financials): Focuses on acquiring, originating, and managing commercial mortgage loans and other commercial real estate-related debt investments. Market cap at $790.55M, most recent closing price at $19.68. Dividend yield at 6.95%. Stock is rallying 1.02% above its 20-day MA, 3.31% above its 50-day MA, and 16.21% above its 200-day MA. Shares shorted have increased from 797.80K to 1.17M over the last month, an increase which represents about 1.15% of the company’s float of 32.45M shares. Days to cover ratio at 3.1 days.

2. SouFun Holdings Ltd. (SFUN, Earnings, Analysts, Financials): Provides marketing, listing, technology, and information consultancy services to real estate and home furnishing industries in the People’s Republic of China. Market cap at $331.28M, most recent closing price at $17.83. Dividend yield at 5.27%. Stock is rallying 3.58% above its 20-day MA, 20.46% above its 50-day MA, and 21.05% above its 200-day MA. Shares shorted have increased from 2.33M to 2.57M over the last month, an increase which represents about 1.79% of the company’s float of 13.43M shares. Days to cover ratio at 13.32 days.

3. Nacco Industries Inc. (NC, Earnings, Analysts, Financials): Engages in lift trucks, small appliances, specialty retail, and mining businesses primarily in the Americas, Europe, and the Asia-Pacific. Market cap at $344.28M, most recent closing price at $50.63. Dividend yield at 4.21%. Stock is rallying 1.69% above its 20-day MA, 22.44% above its 50-day MA, and 41.84% above its 200-day MA. Shares shorted have increased from 149.89K to 279.67K over the last month, an increase which represents about 2.45% of the company’s float of 5.29M shares. Days to cover ratio at 5.46 days.

4. American Greetings Corp. (AM, Earnings, Analysts, Financials): Engages in the design, manufacture, and sale of greeting cards and other social expression products worldwide. Market cap at $542.11M, most recent closing price at $17.15. Dividend yield at 3.47%. Stock is rallying 0.79% above its 20-day MA, 7.93% above its 50-day MA, and 16.69% above its 200-day MA. Shares shorted have increased from 13.23M to 13.74M over the last month, an increase which represents about 1.84% of the company’s float of 27.79M shares. Days to cover ratio at 31.75 days.

This article was originally written by Rebecca Lipman, and posted on Kapitall.