Harley Finkelstein: Just want to add to that. Just in terms of €“ one thing that I think a lot of you that have been studying the company for a while know is that one of the best traits €“ one of the best quality about Shopify is our ability to navigate through different macro environments, different consumer trends, different business changes. Pre-COVID, you saw us operating with a particular efficiency, but also a particular eye on growth. During COVID, when things shut down, we went to work to help merchants move online. We also simultaneously during COVID went to work on building the greatest point-of-sale product because we knew at some point, post-COVID stores are going to reopen. And once stores did reopen, we went hard in replacing all of those legacy systems with ours.

So I think we’ve always operated well in any environment. But that flexibility €“ we can adjust to that. And I think economic environments like the one we’re in right now potentially is when merchants need us most. Shopify lowers the barrier entrepreneurship, and we’re packed with value. Just to repeat something Tobi said because it’s very important. We were not raising venture capital like a lot of other companies were. If you look at our seven years since IPO, we were profitable five out of the seven and we like being profitable, and we’re going to work towards that. We were cash flow positive in Q4. We were AOI positive in Q4, which was the highest AOI quarter of the year. And we’re going to continue to push towards greater efficiency and be mindful of CapEx. That’s just the way we operate.

We are incredibly resilient as a business and as a company, and we’ll continue to do that.

Amy Feng: Our next question will come from Todd Coupland at CIBC. Please go ahead with your question.

Todd Coupland: Great. Can you hear me okay?

Harley Finkelstein: Yes.

Todd Coupland: Yes. Great. Good evening, everyone. I wanted to ask about the impact of the price increase of your plans. Obviously, it’s not going to impact Q1 very much. So if you could give us some color on that and the expected cadence through the year, that’d be great. Thanks a lot.

Harley Finkelstein: Sure. It’s Harley. I’ll take that one again. Look, our plan pricing has pretty much remained unchanged since I got here 13 years ago. In the same time, we’ve added significant value to our subscription offering to our merchants. And I €“ we want to keep making commerce better in it. So I think the price increase reflects a fair value exchange, but it also allows us to keep solving really, really tough problems and empower more people to become entrepreneurs. And so it’s still early days. We’re watching this closely, but I think people view Shopify as incredible value whether you’re just getting started or you’re a much larger merchant on Plus or CCS. And so again, the value to cost ratio across every single Shopify product and Shopify plan is very much on the side of value. And so I think that €“ I think merchants understand it. And I think that the merchants that pay for Shopify every month believe they’re getting incredible value from us.

Amy Feng: Our next question will come from Tim Chiodo at Credit Suisse. Please go ahead.

Tim Chiodo: Great. Thank you, Amy. I want to talk a little bit about the Shop Pay accelerated checkout button. So the penetration gain is clearly impressive, now approaching about 20% of GMV. I wanted to touch on two minor or quick items. The first one is the 100 million number that you mentioned in terms of the opted-in. Could you talk a little bit about the percentage of those or maybe just give a number that €“ or a rough directional number that are more of a monthly active user. And then the second part is around, yes, you’ve mentioned using Facebook, Instagram, et cetera, going off platform with social platforms, but what about the possibility of the Shop Pay button appearing on other non-Shopify merchants, meaning traditional maybe enterprise retailers that are not working with Shopify?

Harley Finkelstein: It’s a great question, specifically, I guess, because Shop Pay is becoming consumer’s favorite way to check out. And we won’t go into any more details just in terms of the exact numbers. But right €“ we did disclose that 100 million buyers how opted-in into Shop Pay. We have in €“ we have now seen about $11 billion in GMV go through Shop Pay in Q4 alone, cumulative about $77 billion since its launch in 2017. So we know that consumers really love it. We know merchants really like it because it increases speed and increases conversion rate. And so in terms of what we’re going to do in terms of our focus for 2023, we want to make it easier as possible for more merchants and more consumers to use it. In terms of moving beyond just Facebook and Instagram and buying Google, and we rolled out Shop Pay on YouTube as well in Q3 of 2022, we’d like to see it in more places, and we’re now working towards that.

But I think so far, Shop Pay GMV increased 43% year-on-year in Q4. It is now the number one accelerated checkout across the entire Shopify platform for millions of merchants. So we think that we have a really real opportunity to continue to put that in more services. And again, the more places that have Shop Pay, the more merchants make money. We like that. So you’ll see more Shop Pay in more places.

Amy Feng: Our next question will come from Clarke Jeffries at Piper Sandler. Please go ahead with your question.

Clarke Jeffries: Hello, thank you for taking the question. I wanted to ask for an update or learnings on the changes you made to the sales funnel with the rollout of free and paid trial experiences in the second half of last year. And I think in the broader context of the pricing change, maybe you can help us understand where we’re at in terms of demand or merchant growth in the non-Plus category. Do you see that as improving in the coming year, stable or slowing?

Harley Finkelstein: Yes. So we’ve met a couple of things, and I mentioned this in my remarks. I mean we have a start-up plan we launched in June, which replaced existing life plan, so make it much easier for aspiring entrepreneurs to get up and running on Shopify and test of their product market fit. We like that because it opens up the funnel for more people to try their hand and entrepreneurship. We also did international initiatives. We did a localized subscription pricing and then local currency billing, again, because we want to take advantage of what we’re seeing as demand from international countries. And so we think on the localized pricing, it better aligns pricing with our most popular plans, and we can offer that in, as I mentioned, 200 countries.

It really €“ the impact of that is mostly on the Shopify plan and the Basic plans. So that, again is our €“ that is our desire to expand how many people use Shopify and where they’re coming from. In terms of the free and paid trial, it allows us to get more merchants trying playing with Shopify. Again, the idea is we’re not changing physics here. Not every merchant will be successful. But the key for us is that we want Shopify to be the place that everybody goes to start a business. Some of those businesses won’t succeed, but the ones that do €“ it’s in our investor deck on our investor site. The ones that do succeed stay with us indefinitely. They take more and more of our Merchant Solutions. I mean we haven’t even got a chance related to talk about our attach rate, which is almost 2.85% this year relative to 2.55% last year.

I mean that is a proxy for the value and the amount of services and products our merchants use. So all of these, whether it’s the paid trial or it’s international initiative versus the starter plan, we want to get as many people using their hand at Shopify as possible and ensure the ones are successful become large merchants in the long run, and those things reflect that opportunity for us.

Amy Feng: Our next question will come from Michael Morton at Moffett Nathanson. Please go ahead with your question.

Michael Morton: Thank you for the question. With Deliverr integrated and CapEx being deployed on SFN, I was wondering if you could share how you view your return on investment for the money that’s going to be allocated in SFN going forward. And I do appreciate that there’s a lot of moving parts behind that.

Jeff Hoffmeister: Yes. Thanks a lot. This is Jeff. Let me tackle that one. So we are €“ in terms of backdrop and where we are on the integration of Deliverr, as you know, this was completed in July. So we’re roughly six months into this. And from a CapEx perspective, as we mentioned, it was $8 million that we spent in Q4. We want to make sure that we get the Deliverr integration fully done before, obviously, we ramp up CapEx on that. But we are being really, really mindful. I think we’ve learned some with the management team of Deliverr, the technology of Deliverr, the business plan of Deliverr. We’ve been able to do some really interesting things and do some things in a way, which I think is much more CapEx light than maybe originally anticipated.

And that has to do with €“ I mean Harley has talked a lot in the past around the number of SKUs that we need to manage versus someone like Amazon. It’s a very, very different business model. And that allows us to be more thoughtful in terms of how we leverage partners. And so I think not only the business model, but also the way we leverage partners is going to allow us to do some things, which is pretty interesting in terms of how we think about Deliverr. And this is not even to mention the software, which Deliverr brought to us, which is also proving to be a real differentiator.

Amy Feng: Our next question will come from Andrew Bauch at SMBC Nikko. Please go ahead with your question.

Andrew Bauch: Hey guys, thank you for taking the question. Just want to get a sense of your guidance philosophy year, not guidance, but the commentary you’ve made around 1Q. What you’ve kind of seen quarter-to-date and how you kind of build to that high teens number because when we kind of consider some of the initiatives that are clearly showing momentum, it was €“ it came in a little bit lighter than what we had anticipated.

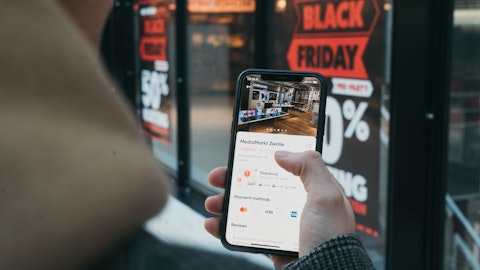

Jeff Hoffmeister: Yes. Let me start with that one. Reminder, of course, Q1 is our seasonally low quarter. We still feel very good, as you alluded, to the new products that we introduced last year. And we feel really good about the solutions we had with our merchants, including all the additional solutions that we unveiled last year. And as you know, from our commentary around Black Friday, Cyber Monday, that was a very good weekend for us. And overall, when you look at Q4, we definitely outperformed well the market in terms of comparing our results versus the broader e-commerce market. That said, we’re also mindful of this macroeconomic environment, and that’s just a simple reality of where we are right now. But in terms of our own solution, in terms of our own business, we feel really, really good about what we’re doing.

Amy Feng: We have time for two more questions. Our next question will come from Samad Samana at Jefferies. Please go ahead with your question.

Samad Samana: Hi. Great. Thanks for taking my question. So I wanted to follow up on the €“ on adding new merchants and €“ with a listing of the commentary, but I guess just how should we think about maybe the different proportions at the top of the funnel the amount of leads that are coming in that are trying the product. And then just how are you thinking about merchant growth in 2023, especially as we think about in the context of the last couple of years where we’ve had some very, very strong years and have some tough comps against that. Just what’s the company thinking as far as bringing new merchants onto the platform and what are you assuming? Thank you.