Baron Funds, an investment management company, released its “Baron Health Care Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. In the fourth quarter, the fund increased by 9.08% (Institutional Shares) compared to an 11.54% gain for the Russell 3000 Health Care Index and a 7.56% gain for the S&P 500 Index. The fund fell 16.90% in 2022, compared to a 6.10% decline for the Russell 3000 Health Care Index and an 18.11% decline for the S&P 500 Index. Factors like cash exposure in the up-market, adverse stock selection, and differences in sub-industry exposures led the fund to underperform in the quarter relative to its benchmark. In addition, please check the fund’s top five holdings to know its best picks in 2022.

Baron Funds highlighted stocks like HCA Healthcare, Inc. (NYSE:HCA) in the Q4 2022 investor letter. Headquartered in Nashville, Tennessee, HCA Healthcare, Inc. (NYSE:HCA) is a US-based healthcare services provider. On January 30, 2023, HCA Healthcare, Inc. (NYSE:HCA) stock closed at $253.30 per share. One-month return of HCA Healthcare, Inc. (NYSE:HCA) was 5.56%, and its shares gained 5.52% of their value over the last 52 weeks. HCA Healthcare, Inc. (NYSE:HCA) has a market capitalization of $71.612 billion.

Baron Funds made the following comment about HCA Healthcare, Inc. (NYSE:HCA) in its Q4 2022 investor letter:

“We initiated a position in HCA Healthcare, Inc. (NYSE:HCA), one of the nation’s leading providers of health care services. As of September 30, 2022, HCA owned, managed, or operated 182 hospitals and approximately 2,400 ambulatory sites of care in 20 states and the U.K. We think long-term demographic trends as well as HCA’s strong presence in attractive growth markets where there is net population migration position the company well to generate sustainable long-term growth. Prior to the COVID pandemic, management targeted long-term top-line organic growth of 4% to 6% with pricing/mix running in the 2% to 3% range and adjusted patient admissions increasing 2% to 3%. Although COVID has been disruptive to this framework, management believes organic revenue growth can return to its targeted 4% to 6% range with positive margin leverage possible at the high end of the range. Recently, the company has seen contract labor costs and wage pressure start to moderate and volume trends are improving. HCA also has a long-term track record returning capital to shareholders through special dividends and share repurchases.”

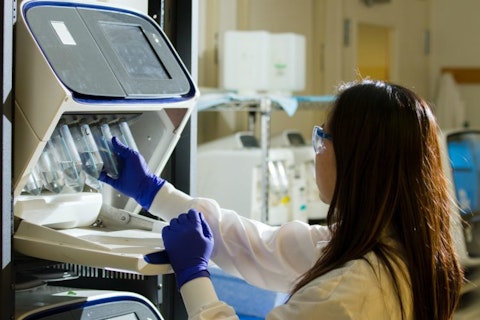

national-cancer-institute-GcrSgHDrniY-unsplash

HCA Healthcare, Inc. (NYSE:HCA) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 64 hedge fund portfolios held HCA Healthcare, Inc. (NYSE:HCA) at the end of the third quarter, which was 63 in the previous quarter.

We discussed HCA Healthcare, Inc. (NYSE:HCA) in another article and shared Oakmark Funds’ views on the company. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Countries with the Largest Refining Capacity

- Top 25 Agrochemical Companies in the World

- 25 Companies that Make the Most Money in the World

Disclosure: None. This article is originally published at Insider Monkey.