10 Best Stocks to Buy According to Elliott Investment Management

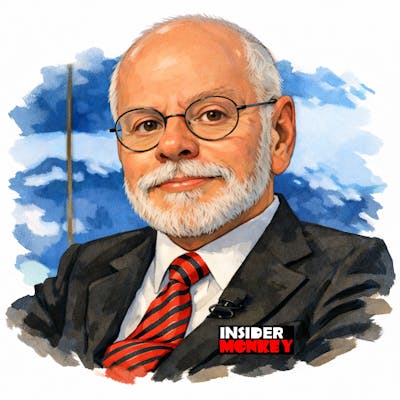

Elliott Investment Management, founded in 1977 by Paul Singer, is one of the oldest fund managers in the industry.

Hedge Funds

News & Analysis

Top Fund Managers

Best Performing Funds

Featured Content

Insider Trading

News & Analysis

Latest Insider Purchases

Teuber bought 3,000 Ionq Inc. shares at $38.39

Welch bought 60 Patrick Industries Inc shares at $122.75

Clark bought 5,310 Rexford Industrial Realty Inc. shares at $37.73

Stockert bought 5,000 Rexford Industrial Realty Inc. shares at $37.39

Fitzmaurice bought 2,650 Rexford Industrial Realty Inc. shares at $37.55

Latest Insider Sales

Cardillo sold 5,165 Ionq Inc. shares at $39.44

Tenner sold 2,029 Amalgamated Financial Corp. shares at $38.50

Soderberg sold 20,000 Bloom Energy Corp shares at $180.00

Soderberg sold 25,244 Bloom Energy Corp shares at $177.93

Spenninck sold 19,000 Garrett Motion Inc. shares at $20.28

Featured Content

Do not Miss