At Insider Monkey, we pore over the filings of more than 700 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Sensata Technologies Holding PLC (NYSE:ST) makes for a good investment right now.

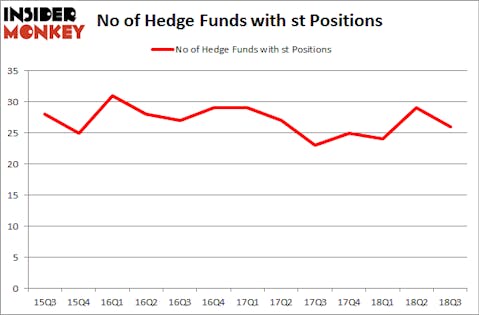

Sensata Technologies Holding PLC (NYSE:ST) has experienced a decrease in enthusiasm from smart money of late. Our calculations also showed that st isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the key hedge fund action surrounding Sensata Technologies Holding PLC (NYSE:ST).

What have hedge funds been doing with Sensata Technologies Holding PLC (NYSE:ST)?

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from one quarter earlier. On the other hand, there were a total of 25 hedge funds with a bullish position in ST at the beginning of this year. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

More specifically, Generation Investment Management was the largest shareholder of Sensata Technologies Holding PLC (NYSE:ST), with a stake worth $450.2 million reported as of the end of September. Trailing Generation Investment Management was Cantillon Capital Management, which amassed a stake valued at $224.5 million. Cantillon Capital Management, SQ Advisors, and Ashe Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Sensata Technologies Holding PLC (NYSE:ST) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedgies that elected to cut their full holdings in the third quarter. Interestingly, John Overdeck and David Siegel’s Two Sigma Advisors said goodbye to the biggest stake of the “upper crust” of funds monitored by Insider Monkey, worth close to $8.3 million in stock, and John Kim’s Night Owl Capital Management was right behind this move, as the fund cut about $2.1 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Sensata Technologies Holding PLC (NYSE:ST) but similarly valued. We will take a look at ServiceMaster Global Holdings Inc (NYSE:SERV), Twilio Inc. (NYSE:TWLO), DENTSPLY SIRONA Inc. (NASDAQ:XRAY), and ICON Public Limited Company (NASDAQ:ICLR). This group of stocks’ market caps are similar to ST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SERV | 36 | 1172425 | 4 |

| TWLO | 41 | 1168477 | 9 |

| XRAY | 28 | 1252948 | 5 |

| ICLR | 22 | 577377 | 7 |

| Average | 31.75 | 1042807 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.04 billion. That figure was $1.55 billion in ST’s case. Twilio Inc. (NYSE:TWLO) is the most popular stock in this table. On the other hand ICON Public Limited Company (NASDAQ:ICLR) is the least popular one with only 22 bullish hedge fund positions. Sensata Technologies Holding PLC (NYSE:ST) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TWLO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.