We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Sarepta Therapeutics Inc (NASDAQ:SRPT).

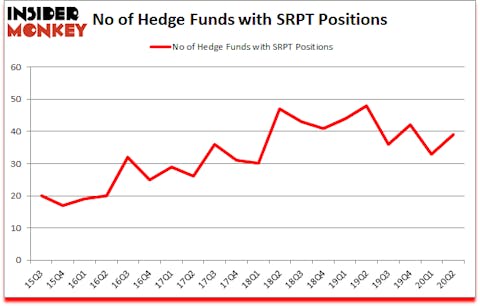

Is Sarepta Therapeutics Inc (NASDAQ:SRPT) a healthy stock for your portfolio? Hedge funds were betting on the stock. The number of bullish hedge fund bets increased by 6 lately. Sarepta Therapeutics Inc (NASDAQ:SRPT) was in 39 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 48. Our calculations also showed that SRPT isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most traders, hedge funds are seen as slow, old financial tools of yesteryear. While there are over 8000 funds in operation at the moment, We look at the masters of this club, around 850 funds. These investment experts command bulk of all hedge funds’ total asset base, and by monitoring their top equity investments, Insider Monkey has identified several investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Michael Johnston of Steelhead Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Our analysis determined that presidential election polls were wrong heading into the 2020 election and we were able to make the most accurate predictions in the country after making adjustments for the biases in existing polls. For example we predicted comfortable Trump victories in Florida, North Carolina, Texas, Iowa, and Ohio. We also predicted a very narrow Biden victory of 0.4 points in Wisconsin when most pollsters were predicting 8 to 10 points Biden victories. We are waiting for the results of 5 more states, but our accuracy rate so far is 100% (see our predictions). You can subscribe to our free daily newsletter on our website to get email alerts whenever we publish an interesting article. Keeping this in mind let’s view the new hedge fund action encompassing Sarepta Therapeutics Inc (NASDAQ:SRPT).

What have hedge funds been doing with Sarepta Therapeutics Inc (NASDAQ:SRPT)?

At second quarter’s end, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SRPT over the last 20 quarters. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

The largest stake in Sarepta Therapeutics Inc (NASDAQ:SRPT) was held by Avoro Capital Advisors (venBio Select Advisor), which reported holding $268.6 million worth of stock at the end of June. It was followed by Adage Capital Management with a $176.4 million position. Other investors bullish on the company included OrbiMed Advisors, Casdin Capital, and Farallon Capital. In terms of the portfolio weights assigned to each position Avoro Capital Advisors (venBio Select Advisor) allocated the biggest weight to Sarepta Therapeutics Inc (NASDAQ:SRPT), around 5.31% of its 13F portfolio. Casdin Capital is also relatively very bullish on the stock, earmarking 5.03 percent of its 13F equity portfolio to SRPT.

Now, key money managers were leading the bulls’ herd. Duquesne Capital, managed by Stanley Druckenmiller, assembled the most outsized position in Sarepta Therapeutics Inc (NASDAQ:SRPT). Duquesne Capital had $27.2 million invested in the company at the end of the quarter. Kamran Moghtaderi’s Eversept Partners also initiated a $11.5 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Guy Levy’s Soleus Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks similar to Sarepta Therapeutics Inc (NASDAQ:SRPT). We will take a look at Hewlett Packard Enterprise Company (NYSE:HPE), Grifols SA (NASDAQ:GRFS), Nucor Corporation (NYSE:NUE), FactSet Research Systems Inc. (NYSE:FDS), Seagate Technology plc (NASDAQ:STX), Masimo Corporation (NASDAQ:MASI), and AngloGold Ashanti Limited (NYSE:AU). All of these stocks’ market caps match SRPT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HPE | 31 | 693633 | 2 |

| GRFS | 21 | 583023 | -2 |

| NUE | 26 | 115702 | 0 |

| FDS | 21 | 200608 | 0 |

| STX | 27 | 2100119 | -5 |

| MASI | 32 | 160712 | 1 |

| AU | 16 | 726270 | -3 |

| Average | 24.9 | 654295 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.9 hedge funds with bullish positions and the average amount invested in these stocks was $654 million. That figure was $1148 million in SRPT’s case. Masimo Corporation (NASDAQ:MASI) is the most popular stock in this table. On the other hand AngloGold Ashanti Limited (NYSE:AU) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Sarepta Therapeutics Inc (NASDAQ:SRPT) is more popular among hedge funds. Our overall hedge fund sentiment score for SRPT is 84.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Unfortunately SRPT wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on SRPT were disappointed as the stock returned -15.2% since the end of the second quarter (through 10/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Sarepta Therapeutics Inc. (NASDAQ:SRPT)

Follow Sarepta Therapeutics Inc. (NASDAQ:SRPT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.