Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in salesforce.com, inc. (NYSE:CRM)? The smart money sentiment can provide an answer to this question.

salesforce.com, inc. (NYSE:CRM) has seen an increase in activity from the world’s largest hedge funds of late. Not only that but also Salesforce.com was actually the 18th most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds). Earlier this year Riverpark Capital said the following about CRM:

“CRM has consistently grown revenue at greater than 20% each year since its founding in 1999 to more than $10 billion in sales last year. We believe that through price increases and new products to cross-sell to its large customer base, Salesforce can continue to drive greater than 20% annual revenue growth for the long-term. In fact, following a 48% increase in the company’s backlog in its most recent quarter, Marc Benioff, the company’s CEO, said he’d “never seen a demand environment like this,” as companies accelerate their investments around digital transformation initiatives, which plays squarely into Salesforce’s strengths.

Most importantly to us, after years of profitless pursuit of top-line growth, a combination of operating leverage and recent cost discipline has resulted in 15% operating margins (and a greater than 60% growth in free cash flow) that we believe are poised to expand significantly. We believe the company’s ongoing growth and cost initiatives pave the way to 20%-25% operating margins over the next four years and greater than 30% longer term. Although CRM has been a strong stock during its transition to strong profit growth, we believe that a period of rapidly expanding profit and free cash flow growth will support continued outperformance of the company’s shares in the years to come.”

To the average investor there are numerous indicators market participants have at their disposal to evaluate stocks. Two of the most under-the-radar indicators are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the market by a very impressive margin. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here).

We’re going to view the latest hedge fund action surrounding salesforce.com, inc. (NYSE:CRM).

What does the smart money think about salesforce.com, inc. (NYSE:CRM)?

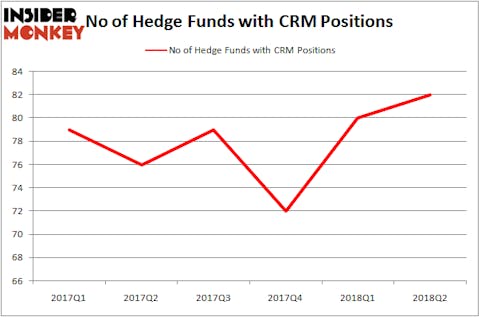

Heading into the fourth quarter of 2018, a total of 82 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the previous quarter. On the other hand, there were a total of 76 hedge funds with a bullish position in CRM at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Aaron Cowen’s Suvretta Capital Management has the number one position in salesforce.com, inc. (NYSE:CRM), worth close to $431 million, comprising 11.4% of its total 13F portfolio. On Suvretta Capital Management’s heels is Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $412.7 million position; 1% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish contain John Hurley’s Cavalry Asset Management, Eashwar Krishnan’s Tybourne Capital Management and Stanley Druckenmiller’s Duquesne Capital.

As industrywide interest jumped, key money managers were breaking ground themselves. Cavalry Asset Management, managed by John Hurley, initiated the biggest position in salesforce.com, inc. (NYSE:CRM). Cavalry Asset Management had $34.9 million invested in the company at the end of the quarter. Paul Holland and Matthew Miller’s Glaxis Capital Management also initiated a $0.7 million position during the quarter. The other funds with new positions in the stock are Ben Gambill’s Tiger Eye Capital, Nick Niell’s Arrowgrass Capital Partners, and Bain Capital’s Brookside Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as salesforce.com, inc. (NYSE:CRM) but similarly valued. These stocks are United Technologies Corporation (NYSE:UTX), GlaxoSmithKline plc (ADR) (NYSE:GSK), Sanofi SA (ADR) (NYSE:SNY), and Paypal Holdings Inc (NASDAQ:PYPL). All of these stocks’ market caps are similar to CRM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UTX | 52 | 6607445 | 2 |

| GSK | 21 | 1194040 | 0 |

| SNY | 23 | 887312 | -1 |

| PYPL | 86 | 4904464 | 2 |

As you can see these stocks had an average of 45.5 hedge funds with bullish positions and the average amount invested in these stocks was $3398 million. That figure was $4905 million in CRM’s case. Paypal Holdings Inc (NASDAQ:PYPL) is the most popular stock in this table. On the other hand GlaxoSmithKline plc (ADR) (NYSE:GSK) is the least popular one with only 21 bullish hedge fund positions. salesforce.com, inc. (NYSE:CRM) is not the most popular stock in this group but hedge fund interest is still above average. Considering that hedge funds have been right about CRM so far and the stock significantly outperformed the market, it may be a good idea to take advantage of the recent weakness in the stock price and initiate a position.

Disclosure: None. This article was originally published at Insider Monkey.