Company summary

Rock-Tenn Company (NYSE:RKT) provides containerboards, packaging, and pre-printed linerboards for corrugated boxes, and industrial and consumer product manufacturers. They also convert corrugated sheets into corrugated products; and provide structural and graphic design and engineering services, and packaging machines.

Bottom line: the application of their products is seemingly endless and is in steady and growing domestic and global demand. If you as a consumer buy a product it’s typically boxed or wrapped, it could be Rock-Tenn Company (NYSE:RKT).

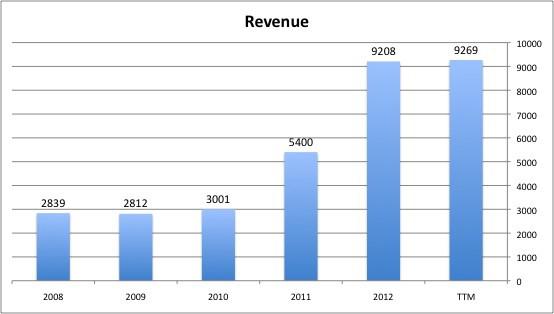

Revenue Growth Supported by CAPex

The correlation between Revenue Growth and Capital Expenditures with Share Price should be clearly evident upon examination. We see the benefit to investing back into the business here. Rock-Tenn’s management has been vocal about continuing this trend.

Cash is king

As referenced earlier, Rock-Tenn Company (NYSE:RKT) has produced strong and steady cash flows and has consistently maintained a Free Cash Flow/Net Income Ratio greater than 1, a sign of quality earnings in my book. Remember how this ratio works. If a company is playing accounting games (ie. Enron) than we will see Net Income but won’t see the accompanying Cash Flow. If the two are similar (ratio around 1) then we are confident they are ‘converting Net Income into real Cash Flow’.

Rock-Tenn plans to reinvest $450 million towards capital maintenance, equipment and infrastructure modernization/upgrades, and high-return, cost-reducing projects that improve operational efficiency. Operating Cash Flows have been growing with revenues and have averaged 9% of Revenues over the past decade. As seen below, reinvestment back into the firm has consumed a greater portion of these cash flows in the past year and a half and this has translated to both revenue and share price growth. All this indicates long-term thinking by management, investing in the future of the company.

International Paper Company (NYSE:IP) is seen following suit in the same fashion. They are investing a huge amount of money in expanding their business and upgrading machinery. In the last 3 years alone they have spent more than $7 billion on the business, a fairly large sum for a $21 billion company. The race between International Paper Company (NYSE:IP) and Rock-Tenn Company (NYSE:RKT) will be competitive and ultimately lead to consolidation in this industry. Look for smaller players like Clearwater Paper Corp (NYSE:CLW) to become potential acquisition targets. At a current market cap of just over $1 billion we would be more likely to see International Paper Company (NYSE:IP) make a play for Clearwater Paper Corp (NYSE:CLW), as they have roughly a billion in cash right now. Rock-Tenn has only $60 million in cash but is no stranger to raising $1 billion+ to purchase a company, as they did in 2011.