RGM Capital is a Florida-based hedge fund managed by Robert G. Moses. The fund manages an equity portfolio worth $888.15 million as of September 30 and its stock picks returned 11.32% when looking at its 9 long positions in companies which had a market cap of at least $1 billion on June 30. Four of its favorite stocks as of that date were Lam Research Corporation (NASDAQ:LRCX), Acxiom Corporation (NASDAQ:ACXM), Callidus Software Inc. (NASDAQ:CALD), and Blackbaud, Inc. (NASDAQ:BLKB), which we’ll look at in this article.

Hedge funds had a pretty solid run for much of this year, generating positive returns for seven or eight consecutive months (depending on the source) before that streak came to an end in October. The third-quarter was a particularly strong one for the industry, as evidenced by our own data. 659 funds in our system which filed for the June 30 13F reporting period held long positions in at least 5 non-micro-cap stocks, and those funds’ long bets posted 8.3% gains in the third-quarter based on the size of their positions on June 30. That easily bested the performance of S&P 500 ETFs, which returned only 3.3% for the period. Where hedge funds tend to falter is on the other positions in their portfolios (options plays, bonds, etc.), which are there to limit downside risk, but also limit upside potential. That’s why we recommend investors consider hedge funds’ top long bets and share them with readers throughout the year. In this article, we’ll analyze the aforementioned picks and performance of RGM Capital.

Tonis Valing / Shutterstock.com

RGM Capital decreased its stake in Lam Research Corporation (NASDAQ:LRCX) by 14% in the third quarter, ending the period with 728,062 shares of the company. The total worth of the stake was $68.95 million on September 30. The stock returned 13% during the third quarter, so the fund may have been taking some profit from the holding. At the end of the second quarter, a total of 47 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 2% uptick from one quarter earlier. Maverick Capital was the largest shareholder of Lam Research Corporation (NASDAQ:LRCX), with a stake worth $459.4 million reported as of the end of June. Trailing Maverick Capital was Citadel Investment Group, which amassed a stake valued at $204.1 million. Two Sigma Advisors, Alkeon Capital Management, and Columbus Circle Investors also held valuable positions in the company.

Follow Lam Research Corp (NASDAQ:LRCX)

Follow Lam Research Corp (NASDAQ:LRCX)

Receive real-time insider trading and news alerts

RGM Capital held a total of 3.04 million Acxiom Corporation (NASDAQ:ACXM) shares at the end of the third quarter, worth $81.11 million. The position ranked as the fund’s most valuable on September 30 after being raised by 3% during the third quarter. The stock also returned 21.2% during the quarter, which didn’t hurt. At Q2’s end, RGM was one of 15 of the hedge funds tracked by Insider Monkey which held long positions in this stock, unchanged from the first quarter of 2016. Daruma Asset Management held $57.3 million worth of Acxiom’s shares, while Park Presidio Capital, D E Shaw, and Millennium Management were also bullish on Acxiom Corporation (NASDAQ:ACXM).

Follow Liveramp Holdings Inc. (NYSE:RAMP)

Follow Liveramp Holdings Inc. (NYSE:RAMP)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

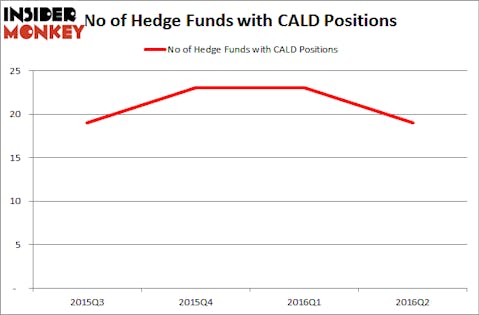

RGM Capital slashed its stake in Callidus Software Inc. (NASDAQ:CALD) by 24% in the third quarter, ending the period with 1.92 million shares of the company. The total value of the updated stake was $35.22 million at the end of September. The position was one of the few disappointments for the fund, as it lost 8.2% during the third quarter. At the end of the second quarter, a total of 19 of the hedge funds in our system were long this stock, a 17% drop from one quarter earlier. Renaissance Technologies, Portolan Capital Management, Driehaus Capital, and Venator Capital Management were some of the other shareholders of Callidus Software Inc. (NASDAQ:CALD).

Follow Callidus Software Inc (NASDAQ:CALD)

Follow Callidus Software Inc (NASDAQ:CALD)

Receive real-time insider trading and news alerts

Lastly, RGM Capital sold off 10% of its Blackbaud, Inc. (NASDAQ:BLKB) shares during the third quarter, heading into the fourth quarter with 597,354 shares of the company worth $39.63 million. The stock also had a less than stellar quarter, dipping by 2.1% during the period. At Q2’s end, 10 hedge funds that we follow were long this stock, a 33% decline from the previous quarter. Among these funds, Select Equity Group held the most valuable stake in Blackbaud, Inc. (NASDAQ:BLKB), which was worth $64.5 million at the end of the second quarter. Moreover, Royce & Associates, Marshall Wace LLP, and Renaissance Technologies were also bullish on Blackbaud, Inc. (NASDAQ:BLKB).

Follow Blackbaud Inc (NASDAQ:BLKB)

Follow Blackbaud Inc (NASDAQ:BLKB)

Receive real-time insider trading and news alerts

Disclosure: None