Kinder Morgan has grown immensely over the years, and many investors believe that the company may have reached its peak. Management predicts organic growth of 2%-3% through increases in volume and prices, and believes the main force fueling their growth will be achieved by expansion and acquisitions. By the end of 2012, KMP will have spent roughly $30 billion on expansions and acquisitions since 1998. At the Barclays Capital CEO Power Energy Conference on Sept. 6, management highlighted $10 billion in investment opportunities which they either already have customer commitments on and are already executing on, or are close to getting customer commitments on. These investment opportunities include $4.1 billion for a Trans Mountain Pipeline expansion in their Kinder Morgan Canada segments, as well as opportunities in the natural gas and CO2 side.

Kinder Morgan’s Structure

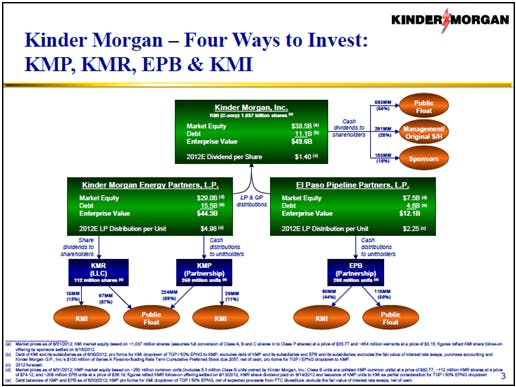

The structure of Kinder Morgan is a little bit complicated, but there’s a reason. It functions effectively, eliminates a number of negative consequences in owning a master limited partnership, and is designed to make ownership more attractive for institutions through tax advantages. The chart below is from the Barclays Capital CEO Power Energy Conference, and helps in understanding the structure of Kinder Morgan.

Instead of organizing as corporations, these companies are organized as large partnerships called master limited partnerships (MLPs), which can issue tradable partnership interests (units) on financial markets. Instead of being taxed two levels like a corporation, energy MLPs are only subject to a single tax. Though it’s a corporation subject to double taxation, Kinder Morgan Inc (NYSE:KMI) contributed most of its $18 billion in income-generating assets to Kinder Morgan Energy Partners, an MLP. KMP, in turn, distributes all of its “available cash” to its partners without first paying taxes. KMP investors benefit, and KMI also benefits because it received a general partner interest in KMP in exchange for the assets it contributed.

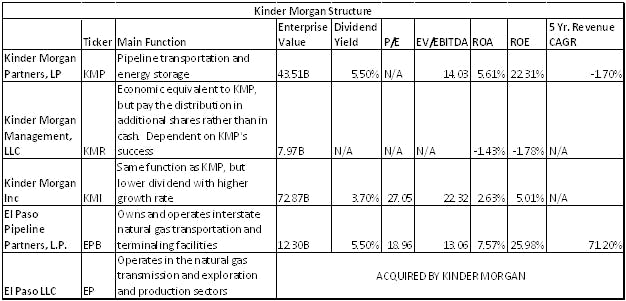

There’s two ways to own limited partner interest in Kinder Morgan, KMP units and Kinder Morgan Management (NYSE:KMR) shares. KMR shares are economically equivalent to the KMP units, but pay the distribution in additional shares rather than in cash. KMP is the entity where 99% of cash receipts comes from, the other 1% is derived from KMI, who is operator of Natural Gas Pipeline Company of America. The second MLP is El Paso Pipeline Partners which came with the El Paso transaction. The executives goal is to own all of their assets within the MLPs. When looking at the enterprises together, total EV is over 100B, making them the third largest energy company in the US behind Exxon and Chevron.

Historically KMR has traded at a discount to KMP. From a fundamental perspective, it should trade at a premium to KMP. You get a higher yield with KMR, and management’s beliefs in the discount of KMR is shown by their insider buys (see here for more). Management has purchased $13.2 million of KMR units, and has only purchased $4.5 million of KMP. Looking at cash-adjusted total returns (CATR), KMR has generated a 15% CATR since their 2001 IPO, versus 15% for the same period for KMP. In 2011, KMP returned 29% while KMR returned 26%. Stretching out returns to two years, KMP returned 58%, while KMR returned 66%. On an ROA and ROE basis, EPB delivered the top results among the Kinder Morgan companies. EPB also has the highest 5 year revenue CAGR, at 71.20% (Click here to see why hedge funds are buying KMP).

The El Paso Deal

The acquisition of El Paso LLC (NYSE:EP), a natural gas transportation and terminaling company, helped Kinder Morgan with their long-term growth problem and expanded their natural gas pipelines. Including the $17 billion outstanding debt of El Paso to subsidiaries, the deal was valued at $38 billion. El Paso assets are primarily interstate natural gas pipelines that have access to key supply regions and major consuming markets. Prior to the acquisition, 38% of Kinder’s cash flows came from natural gas pipelines, and 20% from CO2 oil production. The acquisition is expected boost cash flows from their natural gas pipelines to 54% and their CO2 oil production will now compose 15% of cash flows. Management initially forecasted synergies of $350 million, after closing, Kinder increased their target to $400 million.

The El Paso Deal includes three steps:

1. KMI buys all outstanding shares of EP. This move will immediately grant KMI control over EP’s assets. This step was completed in October 2011, after jumping regulatory hurdles and promising to divest El Paso’s exploration and production business.

2. KMI sells EP’s Exploration & Production (E&P) business. In the second quarter of 2012, Kinder Morgan followed through on their promise and sold El Paso’s exploration and production business. KMI used the proceeds to pay down debt incurred for the cash portion of the buyout of EP.

3. “Drop-down” of EP’s assets to the two MLPs. As a result of the El Paso transaction, there are more assets at KMI, which will drop down to the KMP and El Paso Pipeline Partners LLC (NYSE:EPB), EP’s MLP, over the next couple of years. This will leave KMI as a general partner, but they will have one asset which will not dropdown, a 20% interest in Natural Gas Pipeline Company (NGPL). The drop-down will have to two benefits, (1) it allows KMI to avoid their corporate tax, and (2) to finance the drop-downs, the MLPs sell units to investors, as the newly acquired assets earn income, distributions will increase, which also increases KMI’s general partner interest in the MLPs.

After dissecting the deal and viewing all the players, investors should have a better viewpoint on the opportunity of buying units in KMP and EPB, two MPLs who we believe will benefit from the gradual increase in demand for natural gas (Click to see why T. Boone. Pickens believes natural gas is the alternative energy). These companies have an unparalleled asset footprint, an established track record, and experienced management running the ship.