Fidelity Investments, an investment management company, recently released its “Fidelity Growth Strategies Fund” third quarter 2024 investor letter. A copy of the letter can be downloaded here. Fidelity Growth Strategies Fund is a diversified domestic equity strategy with a focus on mid-cap growth. the fund’s Retail Class shares gained 6.28% in the third quarter, modestly underperforming the 6.54% return of the benchmark Russell Midcap® Growth Index. Throughout the three months, the U.S. Federal Reserve’s long-awaited shift to lowering interest rates, the promise of artificial intelligence, and robust corporate profits boosted U.S. mid-cap growth stocks. Value equities drove the surge, while those with mid- and small-caps outperformed those with large-caps. In addition, you can check the fund’s top 5 holdings to know its best picks in 2024.

Fidelity Growth Strategies Fund highlighted stocks like ResMed Inc. (NYSE:RMD), in the third quarter 2024 investor letter. ResMed Inc. (NYSE:RMD) manufactures, distributes, and markets medical devices and cloud-based software applications for the healthcare markets. The one-month return of ResMed Inc. (NYSE:RMD) was -5.14%, and its shares gained 46.44% of their value over the last 52 weeks. On December 5, 2024, ResMed Inc. (NYSE:RMD) stock closed at $239.41 per share with a market capitalization of $35.144 billion.

Fidelity Growth Strategies Fund stated the following regarding ResMed Inc. (NYSE:RMD) in its Q3 2024 investor letter:

“The fund’s bigger-than-benchmark position in medical equipment designer ResMed Inc. (NYSE:RMD) (+15%) was the next-largest contributor. ResMed’s primary focus is sleep technology – it provides cloud-connected devices for the treatment of respiratory conditions like sleep apnea and chronic obstructive pulmonary disease. The stock declined sharply in the second half of 2023, in the wake of market speculation that the rise of weight-loss drugs would negatively impact sales and usage of ResMed’s devices. But it has risen steadily since then, helped this quarter by an August earnings report that showed steady sales and improving profitability. That said, the stock was no longer in the portfolio at quarter end.”

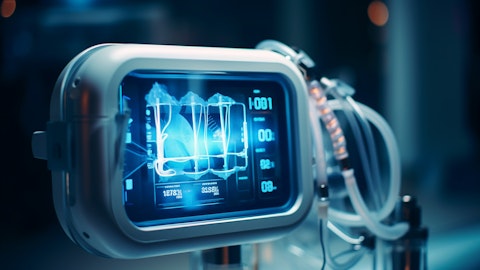

A healthcare professional in a protective mask and headgear adjusting a ventilation device.

ResMed Inc. (NYSE:RMD) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 34 hedge fund portfolios held ResMed Inc. (NYSE:RMD) at the end of the third quarter which was 36 in the previous quarter. ResMed Inc.’s (NYSE:RMD) revenue for the September quarter was $1.22 billion, an increase of 11% on both a headline and constant currency basis. While we acknowledge the potential of ResMed Inc. (NYSE:RMD) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.