It was ugly. After a terrible first quarter, signs of a turnaround at Research In Motion Ltd (NASDAQ:BBRY) are fading. But let’s take a step back from the most recent report and look at the company’s operations in a long-term context.

The sad decline

After years as the industry’s top-dog, Research In Motion Ltd (NASDAQ:BBRY) has conceded its lead to upstarts like Apple Inc. (NASDAQ:AAPL)‘s iOS and Google Inc (NASDAQ:GOOG)‘s Android operating systems.

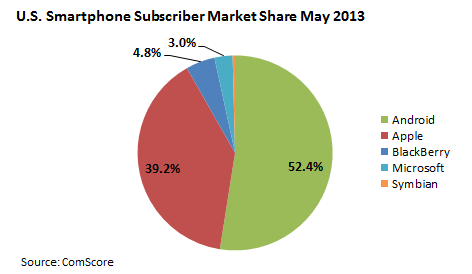

Today, Research In Motion Ltd (NASDAQ:BBRY) has been relegated to third place in the U.S. smartphone market, but steadily losing ground to Microsoft Corporation (NASDAQ:MSFT)’s Windows Phone.

Why such a sudden, spectacular decline?

First – applications. Management misjudge how important applications would become for consumers. According to a report byComScore, apps account for four out of every five minutes spent on a mobile device. BlackBerry was too slow developing its own app ecosystem allowing Google Inc (NASDAQ:GOOG) Play and Apple Inc. (NASDAQ:AAPL)’s App Store to develop huge leads over its own BlackBerry World.

Second – the consumer. BlackBerry failed to catch the wave of consumer smartphone adoption. Its support of web browsing and multimedia eventually looked pathetic against other devices. Only now with BB 10 does it appear the company’s technology has caught up to rivals.

Third – enterprise. Research In Motion Ltd (NASDAQ:BBRY) lost its edge in the corporate space as more organizations adopted Bring-Your-Own-Device, or BYOD, policies. As employees were given more choice, they increasingly picked Android or iOS devices. According to a recent report by IDC, iOS enterprise shipments exceeded BlackBerry for the first time ever in 2012.

No chance of a recovery

Today, the smartphone industry is consolidating into a two-player duopoly. Market share gains are being reinforced by well developed app-communities making it even more difficult for completing systems to catch up.

Currently iOS hold 39.2% of U.S. smartphone market share and accounted for 41.4% of smartphone sales during the month of April.

In addition Android commands a 52.4% hold of the U.S. smartphone market. Because Google Inc (NASDAQ:GOOG) loans out its operating system to manufacturers for free, Android devices enjoy a significant price advantage.

BB10 is not a hit

During the first quarter, Research In Motion Ltd (NASDAQ:BBRY) shipped only 2.7 million BB10 devices – one million less than what analysts had expected. This was particularly disappointing because this was the first full quarter the Z10 handset was available. It looks as though the top-end of the smartphone market where BlackBerry use to dominate is becoming saturated.

Increasingly sales are being driven by mid and low-priced handsets. Blackberry’s Q5 device is a play on emerging markets but it’s unclear if the handset can complete against ultra-cheap Android and Nokia Asha phones.

Tablet failure

Of course, most investors are well aware of Research In Motion Ltd (NASDAQ:BBRY)’s complete failure at capturing almost any slice of the fast growing tablet market.

During the first quarter the company sold only 100,000 Playbook tablets. After a terrible launch, BlackBerry is giving up. The company will not upgrade the Playbook to BB10 conserving resources for its BB10 launch.

Subscriber losses

Perhaps the worst part of BlackBerry’s quarter was the acceleration of the company’s service subscriber losses. Last quarter the company lost four million subscribers. That’s a combined eight million subscriber losses over the past nine months.

These losses suggest that its user base is fleeing. Customers are eager to get out of the two-year contracts they signed in 2010-2011.

This eliminates the bull thesis that BlackBerry could survive as a niche player with a loyal user base that wouldn’t leave for Android or iOS.

Good financials

Blackberry once again swung into the red with the company reporting a $0.16 per share loss.

But once you dig beneath the headline, the company’s financials are surprisingly good.

First, the fact that the company is still relatively near profitability shows how successful management was at cutting costs. Through its CORE program, the company slashed over $1 billion in operating expenses.

Second, the company generated $630 million in cash flow from operations increasing its cash balance to $3.1 billion. Given that the stock now has only a $5.5 billion market capitalization, the cash should put a floor underneath that stock price assuming you give it no value for the company’s patents, its remaining service business, or any possible success of BB10.

But those are only two raisins in a giant loaf of bread.

What does the future hold?

Short sellers are considered to be smarter investors because of the sophistication of their investing techniques.

So what does the smart money think? They’re pretty pessimistic. Investors have sold 35% of the BlackBerry’s outstanding shares short.

Flies usually hover over rotten eggs.

Foolish bottom line

This quarter eliminates a big part of the bull thesis – that Research In Motion Ltd (NASDAQ:BBRY) can survive as a standalone hardware company. To conserve investor capital, it may be time to liquidate the firm.

The article BlackBerry’s Decline in 7 Charts originally appeared on Fool.com and is written by Robert Baillieul.

Robert Baillieul has no position in any stocks mentioned. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple and Google. Robert is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.