We recently published a list of Top 10 AI Stocks That Are Being Monitored By Wall Street. In this article, we are going to take a look at where Reddit, Inc. (NYSE:RDDT) stands against other top AI stocks that are being monitored by Wall Street.

As the global tech sector was catching up to the disruption caused by DeepSeek’s r1 AI model, Chinese e-commerce giant Alibaba announced its brand new Qwen 2.5 AI model on the first day of the Lunar New Year. The Qwen 2.5 is pre-trained on large-scale multilingual and multimodal data and rivals DeepSeek’s AI model.

“Qwen 2.5-Max outperforms … almost across the board GPT-4o, DeepSeek-V3 and Llama-3.1-405B,” the group’s cloud unit on its official WeChat account.

The latest Chinese AI model release also sent US firms scrambling to innovate and stay ahead of the competition. OpenAI CEO Sam Altman recently teased several “exciting new features” coming to ChatGPT and a new ChatGPT Gov tool to bolster ties with the US government.

The rise of advanced, cost-effective Chinese AI models has introduced volatility in US stocks as analysts rampantly rerate companies and shift outlooks based on the rapidly evolving tech landscape.

We selected AI stocks by reviewing news articles, stock analysis, and press releases. We listed the stocks in ascending order of their hedge fund sentiment taken from Insider Monkey’s database of 900 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

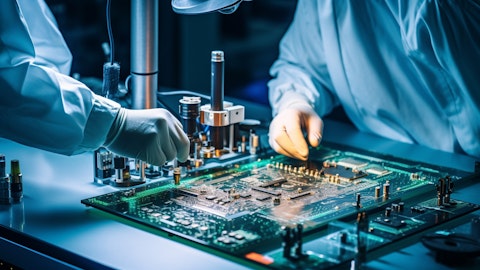

Photo by Annie Spratt on Unsplash

Reddit, Inc. (NYSE:RDDT)

Number of Hedge Fund Holders: 52

Reddit, Inc. (NYSE:RDDT) is a social media platform engaged in social news aggregation and content rating that has surged in popularity in the past years. The social media platform has a data-licensing agreement with OpenAI and Google, where companies pay Reddit, Inc. (NYSE:RDDT) to access its data to enhance AI models. Currently, the social media platform is testing several AI-powered features on the app, including the latest AI Answers feature built on its search architecture to help users quickly find answers to queries from posts across subreds.

On January 28th, Piper Sandler analyst Thomas Champion highlighted a new app feature called Ads Manager, a beta option to import a campaign from the Meta Ads Manager. The brokerage views this as “an interesting strategy that can help onboard advertisers to Reddit from the 10MM+ that currently spend on Meta today,” and is confident it could be a topic of discussion on Reddit, Inc.’s (NYSE:RDDT) earnings call on February 12th. Ahead of the call, Piper Sandler maintained an “Overweight” rating with a $197 target price per share.

Overall, RDDT ranks 7th on our list of top AI stocks that are being monitored by Wall Street. While we acknowledge the potential of RDDT as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than RDDT but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.