Most people with at least basic knowledge of IT infrastructure have heard about Red Hat, Inc. (NYSE:RHT). The company provides one of the most widely-used operating systems for servers. The reason why many consumers may have not heard about this operating system is because Red Hat is mainly for organizations, especially those willing to pay a premium for improved security. Therefore, Red Hat isn’t just another IT stock. The name is synonymous with security, reliability, and fast performance – three must-have success factors that many start-ups would love to possess. Although Red Hat’s cash cow resides in its open source solutions, recently the company has been giving more importance to its cloud storage and virtualization solutions, a fierce business segment where Rackspace Hosting, Inc. (NYSE:RAX) has also been very actively.

However, Red Hat, Inc. (NYSE:RHT) is the only company that started as an open source OS provider and then shifted to cloud services. As you will see later, Red Hat’s open source origins could become a competitive advantage in the war for cloud market share.

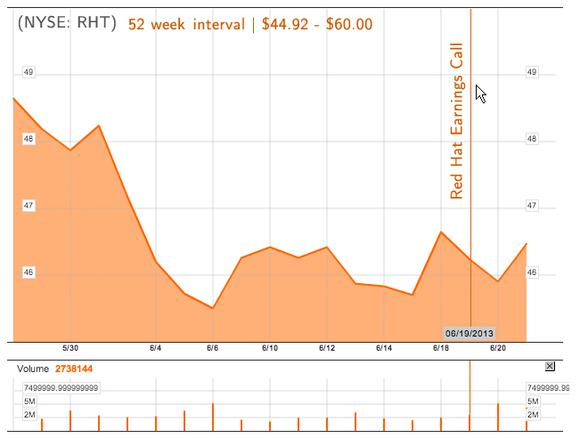

This article develops a bull case for Red Hat, Inc. (NYSE:RHT), taking into consideration the latest earnings results (June 19, 2013), where the company missed the revenue consensus, but won against the Street’s earnings estimates. To maintain neutrality, I present the relevant facts about this stock: the good, the bad, and the ugly.

The Good

Red Hat, Inc. (NYSE:RHT)’s revenue continues growing: first quarter revenue came out at $363 million (up 15% y/y), first quarter subscription revenue came out at $316 million (up 16% y/y), and operating cash flow came out at $142 million (up 14% y/y). The best thing is that revenue is getting more diversified, which is a good signal that Red Hat knows how to address an extremely dynamic and competitive IT industry. In 2005, the company revenue was 100% derived from a subscription business model, but, now, Red Hat is more focused on cloud computing. Subscriptions continue to be the main revenue driver, but there are some other promising aspects like the training and services component ($47 million, up 13% y/y) and middleware services revenue.

Also, after examining Red Hat, Inc. (NYSE:RHT)’s operating expenses, you will see a promising focus on spending on growth opportunities for the future. R&D grew 27%, reflecting additions from last year’s acquisitions and the hiring of new engineers for cloud management, Red Hat OpenStack, and OpenShift technologies, among others. These services are Red Hat’s future and it makes sense to invest heavily in them now. Eventually, the company will reap the rewards from these investments.

Red Hat Storage Solutions, OpenStack, and OpenShift technologies do not produce any significant revenue at the moment, but the picture is likely to change enormously in the next two years. Investing now means getting in at a very early stage of the cycle of Red Hat’s cloud businesses.

The Bad

The growth rate of revenue continues to decrease. Growth has decelerated below 20% over the last year. Management uses terms like “macroeconomic challenging environment” as possible explanations for this decrease. The truth is that the U.S. federal business, which is extremely important for Red Hat, was quite weak in the May quarter. Add to this the fact that many European organizations and governments are still focusing on austerity and you have a strong negative macroeconomic effect on Red Hat’s revenue. Earnings were also hurt by adverse currency fluctuations, specifically the Yen depreciation.

The Ugly

Red Hat, Inc. (NYSE:RHT)’s most promising future products include version seven of Red Hat Enterprise Linux (RHEL) and Red Hat Storage Server, which is software that allows companies to manage server hardware infrastructure easily, and is similar to Amazon.com, Inc. (NASDAQ:AMZN) Web Services. RHEL7, which I expect to be available by the end of 2014, will definitely be a hit, as there hasn’t been any major release in the past two years. The problem lies with Red Hat Storage because competition in this business segment is extremely fierce.