Brad Vizi: We are quite optimistic about the future of Engineering and you almost look at all three segments, or all three units. And with respect Energy Services, we continue to gain traction. We have a number of very large long-term partners as we continue to build confidence project-after-project. In some instances, it is a matter of how much we can take on. So really going back to the core of that strategy, leading with technical capabilities that we think are very much differentiated in the marketplace, with respect to kind of our track record and the talent that we have assembled. And from there, naturally, as you become a preferred partner, the attachment of incremental work is, it can be very substantial. So what you are really seeing there in the case of our Energy Services group is really years of comp.

We are at a bit of a tipping point with respect to compounding of years of goodwill and kind of earning that trust. So we actually have very high expectations going forward for that business. With respect to Aerospace, again, a very strong growth orientation to it. We had a bit of a setback, very late last year, last two weeks or so of the of the year. We are very happy with how the team, dealt with it and rebounded adding incremental clients, several of which are very significant and present, meaningful opportunity to expand within those accounts. So, again, in terms of the upside in that business, we are quite optimistic in 2024 and beyond. And then finally, with respect to process, again, a very, very strong technical capabilities and team.

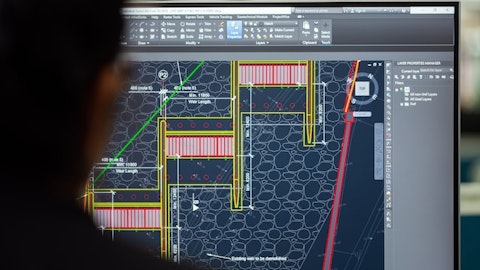

We have clearly invested in that business making sure they have all the tools that they need to continue to build on their reputation and ultimately the financial performance of that business. Inevitably, there will always be an element of lumpiness there. That will be difficult to forecast. However, it is a very IP intensive part of our portfolio and we get paid for that intellectual property. And so, it is a economically very attractive model. So with respect to saying, this quarter is going to be an excellent quarter versus call it Q3 or Q4, that one’s probably the most challenging. However, the returns are very robust. The team is as strong as it is been. There presentation is very much intact. And we believe we continue to build on that.

And so we are optimistic for its performance as well. But very specifically we think that that group has troughed having finished up a couple of large projects and activity is starting to go in the right direction.

Bill Sutherland: So is that the thinking as you look at your fourth quarter range, likely range for revenue and looks like you are quarter-on-quarter flat to maybe off a little bit. So is that just the completion phase and your new work starts to ramp in the first quarter of next year?

Brad Vizi: Yes, no question. There is a little bit of that, but Kevin, do you want to go into very specifically the breakdown within engineering and how we are thinking about that sequential cadence?

Kevin Miller: Sure. I mean, it is difficult to project as Brad said, but we believe what we will see in engineering next year, is a slow sequential uptick as we move throughout the year, right. So we would expect Q1 revenue to be higher than Q4, Q2 to be higher than Q1 and so forth. I’m not sitting here projecting any big giant jumps in any particular quarter, but what I would like to see is single digit sequential growth each quarter with obviously there being some upside depending on what happens with all the different irons we have fire. As you have been covering us a long time, Bill, so you have seen how engineering can really jump in a quarter and stay up for a while depending on what project we have. But in terms of expectations and what we expect to happen I would expect to see a sequential uptake each quarter, and then obviously hope to see if we can really boost that with a couple of big projects.

Bill Sutherland: Got it. Okay. Makes total sense. So what is the other thing I was going to ask you?

Kevin Miller: And we need to continue to work on our margins, because it is not just about adding revenue, right. It is about adding quality revenue and gross profit that gross profit dollars that are driving our return model.