Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Quidel Corporation (NASDAQ:QDEL) changed recently.

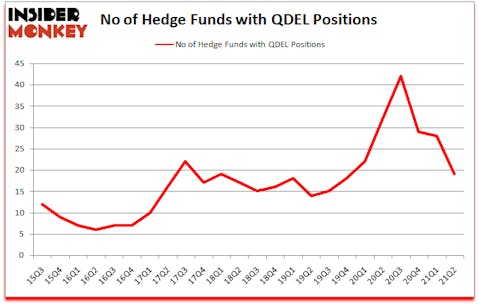

Is Quidel Corporation (NASDAQ:QDEL) a good investment right now? Prominent investors were in a bearish mood. The number of long hedge fund bets dropped by 9 in recent months. Quidel Corporation (NASDAQ:QDEL) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 42. Our calculations also showed that QDEL isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 28 hedge funds in our database with QDEL holdings at the end of March.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

James E. Flynn of Deerfield Management

With all of this in mind let’s go over the fresh hedge fund action surrounding Quidel Corporation (NASDAQ:QDEL).

Do Hedge Funds Think QDEL Is A Good Stock To Buy Now?

At the end of June, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -32% from the first quarter of 2020. On the other hand, there were a total of 32 hedge funds with a bullish position in QDEL a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Richard Mashaal’s Rima Senvest Management has the number one position in Quidel Corporation (NASDAQ:QDEL), worth close to $56.5 million, comprising 1.6% of its total 13F portfolio. The second largest stake is held by James E. Flynn of Deerfield Management, with a $52.4 million position; 0.9% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that are bullish encompass Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management and Mario Gabelli’s GAMCO Investors. In terms of the portfolio weights assigned to each position Birchview Capital allocated the biggest weight to Quidel Corporation (NASDAQ:QDEL), around 4.57% of its 13F portfolio. Rima Senvest Management is also relatively very bullish on the stock, earmarking 1.64 percent of its 13F equity portfolio to QDEL.

Judging by the fact that Quidel Corporation (NASDAQ:QDEL) has faced declining sentiment from hedge fund managers, it’s safe to say that there was a specific group of funds who sold off their positions entirely by the end of the second quarter. Interestingly, Louis Navellier’s Navellier & Associates cut the largest investment of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $3.4 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also sold off its stock, about $3.3 million worth. These transactions are important to note, as total hedge fund interest dropped by 9 funds by the end of the second quarter.

Let’s check out hedge fund activity in other stocks similar to Quidel Corporation (NASDAQ:QDEL). These stocks are Valley National Bancorp (NASDAQ:VLY), Avis Budget Group Inc. (NASDAQ:CAR), Open Lending Corporation (NASDAQ:LPRO), Regal Beloit Corporation (NYSE:RBC), MAXIMUS, Inc. (NYSE:MMS), Pilgrim’s Pride Corporation (NASDAQ:PPC), and Diversey Holdings, Ltd. (NASDAQ:DSEY). All of these stocks’ market caps are similar to QDEL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VLY | 13 | 90860 | -4 |

| CAR | 27 | 1709974 | 6 |

| LPRO | 24 | 433663 | -9 |

| RBC | 31 | 391844 | 1 |

| MMS | 26 | 128750 | 8 |

| PPC | 18 | 88832 | 2 |

| DSEY | 12 | 171364 | -9 |

| Average | 21.6 | 430755 | -0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.6 hedge funds with bullish positions and the average amount invested in these stocks was $431 million. That figure was $219 million in QDEL’s case. Regal Beloit Corporation (NYSE:RBC) is the most popular stock in this table. On the other hand Diversey Holdings, Ltd. (NASDAQ:DSEY) is the least popular one with only 12 bullish hedge fund positions. Quidel Corporation (NASDAQ:QDEL) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for QDEL is 28. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on QDEL as the stock returned 5.3% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Quidel Corp (NASDAQ:QDEL)

Follow Quidel Corp (NASDAQ:QDEL)

Receive real-time insider trading and news alerts

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.