Is QUALCOMM Incorporated (NASDAQ:QCOM) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

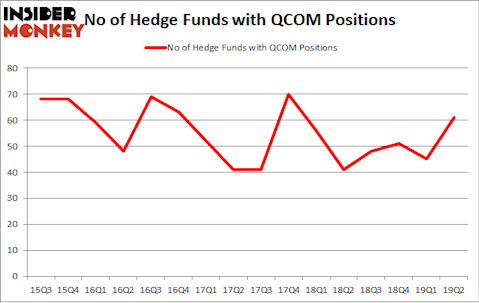

QUALCOMM Incorporated (NASDAQ:QCOM) investors should be aware of an increase in hedge fund sentiment lately. QCOM was in 61 hedge funds’ portfolios at the end of June. There were 45 hedge funds in our database with QCOM positions at the end of the previous quarter. Our calculations also showed that QCOM isn’t among the 30 most popular stocks among hedge funds (see the video at the end of this article).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the recent hedge fund action surrounding QUALCOMM Incorporated (NASDAQ:QCOM).

What have hedge funds been doing with QUALCOMM Incorporated (NASDAQ:QCOM)?

At the end of the second quarter, a total of 61 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards QCOM over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Griffin’s Citadel Investment Group has the biggest call position in QUALCOMM Incorporated (NASDAQ:QCOM), worth close to $329.6 million, amounting to 0.2% of its total 13F portfolio. Coming in second is John Overdeck and David Siegel of Two Sigma Advisors, with a $249.4 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism comprise Cliff Asness’s AQR Capital Management and David Goel and Paul Ferri’s Matrix Capital Management.

Now, specific money managers were leading the bulls’ herd. Matrix Capital Management, managed by David Goel and Paul Ferri, established the biggest position in QUALCOMM Incorporated (NASDAQ:QCOM). Matrix Capital Management had $152.1 million invested in the company at the end of the quarter. Brian Ashford-Russell and Tim Woolley’s Polar Capital also initiated a $133.1 million position during the quarter. The other funds with new positions in the stock are Doug Silverman and Alexander Klabin’s Senator Investment Group, Rob Citrone’s Discovery Capital Management, and Bill Miller’s Miller Value Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as QUALCOMM Incorporated (NASDAQ:QCOM) but similarly valued. We will take a look at General Electric Company (NYSE:GE), Itau Unibanco Holding SA (NYSE:ITUB), Altria Group Inc (NYSE:MO), and American Tower Corporation (REIT) (NYSE:AMT). This group of stocks’ market values are closest to QCOM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GE | 56 | 4499936 | 2 |

| ITUB | 18 | 1084984 | -3 |

| MO | 38 | 942106 | 2 |

| AMT | 42 | 3149112 | 3 |

| Average | 38.5 | 2419035 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.5 hedge funds with bullish positions and the average amount invested in these stocks was $2419 million. That figure was $1722 million in QCOM’s case. General Electric Company (NYSE:GE) is the most popular stock in this table. On the other hand Itau Unibanco Holding SA (NYSE:ITUB) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks QUALCOMM Incorporated (NASDAQ:QCOM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately QCOM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on QCOM were disappointed as the stock returned 1.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.