Not all dividends are created equally; in fact, a high dividend yield is typically a sign of an unsafe stock. That’s why usually any dividend yield over 10% is a sign to run for the hills, instead of a sign to buy. That is of course when we are talking about dividends. On the other hand, when it comes to the distributions paid by an MLP, a 10% yield can be a great buy.

If you are not familiar with MLPs then I’d encourage you to read this. These entities are most commonly found in the energy industry and offer some of the best yields out there these days. So, without further ado, here are two high “dividend stocks” that are not only safe to own, but whose high yields have a good chance of growing even higher in the future.

1. QR Energy LP (NYSE:QRE)

The company pays an exceptionally high yield that’s secured by one of the better hedging programs in its peer group. Given its higher current yield and longer duration hedging policy I see it as a bit of a safer bet than BreitBurn Energy Partners L.P. (NASDAQ:BBEP), which is only 80% hedged this year (though I like BreitBurn a lot). Further, while I might personally prefer Linn Energy LLC (NASDAQ:LINE) and its plan to be 100% hedged for the next four to six years, there are always trade-offs, and in this case the trade-off for QR Energy is a higher current yield.

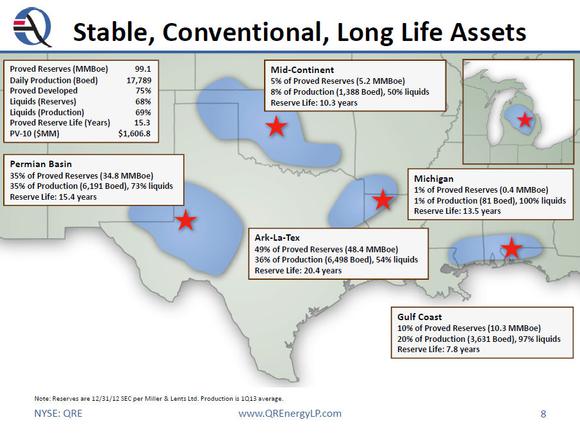

QR Energy LP (NYSE:QRE) has acquired a very liquids-rich asset base (shown below) which will provide years of stable production leading to stable income. They key to growing its payout is to acquire similar low-decline, long-life assets. When you add it all up, QR Energy offers a safe payout of more than 10% that has the potential to go higher.

Source: QR Energy LP (NYSE:QRE)

2. Hi-Crush Partners LP (NYSE:HCLP)

QR Energy and its upstream MLP peers are all indirect beneficiaries of the explosion in onshore oil and gas production. All three benefit from buying mature oil and gas assets from exploration and production companies that need to free up capital to tap our vast shale resources. Hi-Crush Partners LP (NYSE:HCLP) on the other hand is a more direct beneficiary of the shale boom as it provides frac sand which is used in as a proppant in these wells.

Hi-Crush’s business model is simple — its assets include a sand mine in Wisconsin an interest in a second mine in the state. It has very low-cost operations which yields great margins and is one reason why the dividend is so high. Further, thanks to the recently announced purchase of a distribution company, Hi-Crush Partners LP (NYSE:HCLP) sees a visible path to increase its payout in the years ahead. In fact, the cash and stock deal should lead to a distribution increase later this year and a double-digit boost in 2014. That’s means buyers today can lock in a more than 10% current yield.

For some perspective, its competitor U.S. Silica Holdings Inc (NYSE:SLCA) recently announced that it was instituting a quarterly dividend on its stock. At $0.125 per share the yield is just over 2%. While that’s not bad in this low-yield environment, it is still nowhere near Hi-Crush’s payout. Finally, with an average of nearly three years left on its current customer contracts, Hi-Crush Partners LP (NYSE:HCLP)’s payout is very secure and likely to become even more secure as it advances on its many growth opportunities.

Foolish bottom line

Personally, my money is on Hi-Crush. I like its solid 10% yield and visible distribution growth well into the future. That being said, both payouts are secured by long-term contracts which means neither is at risk of being cut in the near future.

The article 2 High Dividend Stocks That Are Still Safe Buys originally appeared on Fool.com and is written by Matt DiLallo.

Motley Fool contributor Matt DiLallo owns shares of LINN Energy, LLC and has the following options: Short Jul 2013 $17.5 Puts on HI-CRUSH PARTNERS LP (NYSE:HCLP) UNIT LTD PARTNER INTS. The Motley Fool recommends BreitBurn Energy Partners L.P. (NASDAQ:BBEP) The Motley Fool owns shares of HI-CRUSH PARTNERS LP UNIT LTD PARTNER INTS and U S SILICA HLDGS INC COM USD0.01.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.