Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Public Service Enterprise Group Incorporated (NYSE:PEG) in this article.

Public Service Enterprise Group Incorporated (NYSE:PEG) has experienced a decrease in support from the world’s most elite money managers lately. Our calculations also showed that PEG isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the latest hedge fund action encompassing Public Service Enterprise Group Incorporated (NYSE:PEG).

What have hedge funds been doing with Public Service Enterprise Group Incorporated (NYSE:PEG)?

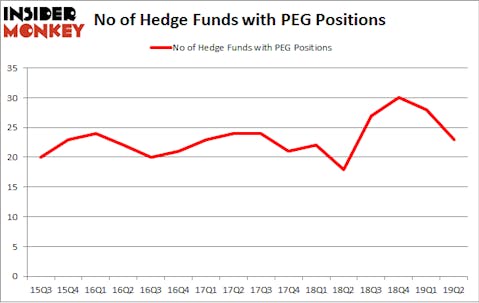

At Q2’s end, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -18% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PEG over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Zimmer Partners held the most valuable stake in Public Service Enterprise Group Incorporated (NYSE:PEG), which was worth $266.2 million at the end of the second quarter. On the second spot was AQR Capital Management which amassed $193.1 million worth of shares. Moreover, Adage Capital Management, Millennium Management, and Two Sigma Advisors were also bullish on Public Service Enterprise Group Incorporated (NYSE:PEG), allocating a large percentage of their portfolios to this stock.

Seeing as Public Service Enterprise Group Incorporated (NYSE:PEG) has faced declining sentiment from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedgies that decided to sell off their entire stakes heading into Q3. Intriguingly, Brian Olson, Baehyun Sung, and Jamie Waters’s Blackstart Capital cut the largest stake of the 750 funds watched by Insider Monkey, valued at about $33.9 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund sold off about $8.1 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 5 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Public Service Enterprise Group Incorporated (NYSE:PEG) but similarly valued. We will take a look at Tyson Foods, Inc. (NYSE:TSN), Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK), Xilinx, Inc. (NASDAQ:XLNX), and Southern Copper Corporation (NYSE:SCCO). This group of stocks’ market caps resemble PEG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSN | 39 | 1442476 | -4 |

| TLK | 7 | 146356 | -2 |

| XLNX | 39 | 1145969 | -17 |

| SCCO | 15 | 202622 | 2 |

| Average | 25 | 734356 | -5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $734 million. That figure was $905 million in PEG’s case. Tyson Foods, Inc. (NYSE:TSN) is the most popular stock in this table. On the other hand Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK) is the least popular one with only 7 bullish hedge fund positions. Public Service Enterprise Group Incorporated (NYSE:PEG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on PEG as the stock returned 6.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.