The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Public Service Enterprise Group Incorporated (NYSE:PEG) and find out how it is affected by hedge funds’ moves.

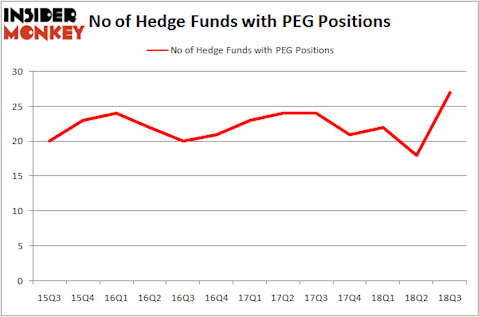

Public Service Enterprise Group Incorporated (NYSE:PEG) has experienced an increase in activity from the world’s largest hedge funds of late. PEG was in 27 hedge funds’ portfolios at the end of September. There were 18 hedge funds in our database with PEG positions at the end of the previous quarter. Our calculations also showed that PEG isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to check out the new hedge fund action surrounding Public Service Enterprise Group Incorporated (NYSE:PEG).

What does the smart money think about Public Service Enterprise Group Incorporated (NYSE:PEG)?

Heading into the fourth quarter of 2018, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the previous quarter. By comparison, 21 hedge funds held shares or bullish call options in PEG heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Public Service Enterprise Group Incorporated (NYSE:PEG), which was worth $246.3 million at the end of the third quarter. On the second spot was Millennium Management which amassed $160.9 million worth of shares. Moreover, Renaissance Technologies, Balyasny Asset Management, and Zimmer Partners were also bullish on Public Service Enterprise Group Incorporated (NYSE:PEG), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Zimmer Partners, managed by Stuart J. Zimmer, initiated the most valuable position in Public Service Enterprise Group Incorporated (NYSE:PEG). Zimmer Partners had $51.6 million invested in the company at the end of the quarter. Jonathan Barrett and Paul Segal’s Luminus Management also initiated a $31.5 million position during the quarter. The following funds were also among the new PEG investors: Brian Olson, Baehyun Sung, and Jamie Waters’s Blackstart Capital, Matthew Tewksbury’s Stevens Capital Management, and ZilvinasáMecelis’s Covalis Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Public Service Enterprise Group Incorporated (NYSE:PEG) but similarly valued. We will take a look at Sprint Corporation (NYSE:S), T. Rowe Price Group, Inc. (NASDAQ:TROW), McKesson Corporation (NYSE:MCK), and Paychex, Inc. (NASDAQ:PAYX). This group of stocks’ market values resemble PEG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| S | 20 | 433099 | 6 |

| TROW | 17 | 396447 | -8 |

| MCK | 42 | 2977552 | 2 |

| PAYX | 30 | 1076148 | 6 |

| Average | 27.25 | 1220812 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.22 billion. That figure was $775 million in PEG’s case. McKesson Corporation (NYSE:MCK) is the most popular stock in this table. On the other hand T. Rowe Price Group, Inc. (NASDAQ:TROW) is the least popular one with only 17 bullish hedge fund positions. Public Service Enterprise Group Incorporated (NYSE:PEG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MCK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.