And next year will be no different. But we don’t frame the dollars, but simply to say, overall, it will be less of a contribution than it was, in the past year. As it relates to the overall, not now, sort of continued active pipeline going to next year, it’s higher than what it was a year ago, which is really positive. Again, we don’t quantify sort of how much higher, but I would say it’s nicely higher. And, and bodes well, considering those generally are always the significant majority of early client wins in every year. And take sort of any year that you look at, they usually represent roughly, 30% or so sort of new client ads in a given year.

Allen Lutz: Thank you.

Operator: Thank you. Your next question is coming from David Larsen from BTIG. Your line is live.

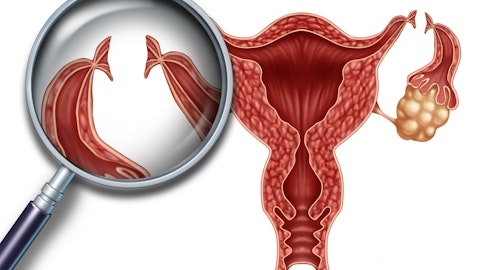

David Larsen: Hi, congratulations on the good quarter. Can you talk about some of the ancillary services that you are getting into, like family planning, for example, or just maternity care, like post birth, just any color there would be very helpful. And any thoughts on the longer term revenue contribution that could come from those areas? Thank you.

Pete Anevski: Sure. So, so we talked about adding preconception services, maternity support, postpartum, male infertility and menopause. Male infertility was live this year. The rest of those are, will be live, one, one, if you will. Relative to contribution, most of the sales we had around those, because they were sort of announced throughout the year, were to existing clients. Although we have some activity with new clients that was positive. I think the bigger contribution will be next year’s sales year. And then the revenue, contribution coming from that will be in the following year. That’ll be meaningful or more meaningful, if you will, versus what we expect in next year.

David Larsen: That’s very helpful. Thank you. And then the question that I keep getting asked from clients is, what’s the state of the economy? What’s the risk of a potential slowdown here? Should the labor market soften a little bit? Can you just maybe give some more color on that? Like in terms of your new client wins, are they all roughly the same size or are more of those coming from sort of midsize, smaller businesses? Or is it held pretty steady in terms of the size of the new client wins? And then even if, even if the labor market softened by, let’s call it one or 200 basis points, in my mind, I’m kind of like, so what? Your top line growth rate, if it slows by 1% or 2%, so what? It’s still so robust. Just any thoughts there would be very helpful. Thank you.

Pete Anevski: Sure. And I think you’re thinking about it the right way. If you remember a year ago this time, there was a lot of concern around announcements that were coming out. I called them headline risk at the time. Mostly tech companies were announcing layoffs. The amount of actual layoffs they were announcing versus their existing client base was single digit percentages collectively. And we had talked about across all the clients that we had, the number of client announcements for layoffs was collectively at that time around 100,000 or so lives. And we framed it the way you’re framing it, which is in the grand scheme of things, and a year ago, I forgot exactly what our lives were, but let’s call it around 3.7 or something million, but don’t hold me exactly to that number.

But either way, it was nothing relative to the overall population. And we also talked about and predicted that even with the layoffs that were announced, whether they were announced, again, where the tech companies announced them, they weren’t announcements that were reduction in force. They were announcements that were what we call right sizing, where they had some reductions, but they still grew overall. A lot of the bigger tech companies that our clients have already talked about that they’re adding employees, not declining employees, etcetera. And even for companies that may have not made large announcements, the net effect of it was non-existent from a reduction in lives perspective versus our prediction from the beginning of the year.