Shares of PowerSecure International, Inc. (NASDAQ:POWR) have taken investors on a fantastic ride this year. The Wake Forest, N.C.-based company has gone from lows near $4 per share in August to current highs near $16 per share. This remarkable run surely leaves investors wondering if now would be a good time to get out.

A record quarter

PowerSecure International, Inc. (NASDAQ:POWR) is coming off of a record first quarter. Here are some of the highlights:

– 35% year-over-year revenue growth

– 6% increase operating profit

– Record $206 million backlog

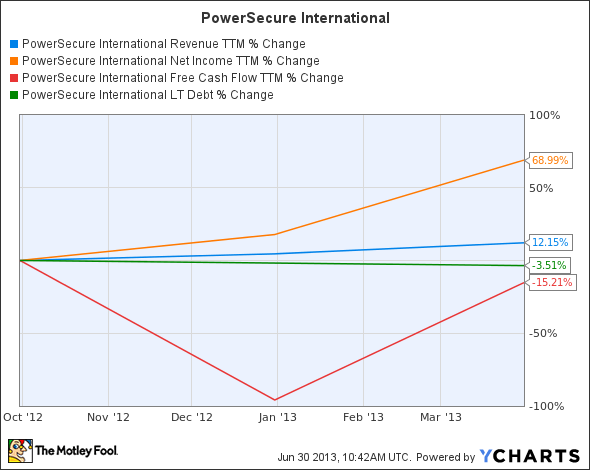

POWR Revenue TTM data by YCharts

Backlog

PowerSecure International, Inc. (NASDAQ:POWR) is touting its impressive record $206 million backlog — a record it expects to break next quarter — as its brightest point. PowerSecure isn’t the only company flaunting recurring revenue. Both SolarCity Corp (NASDAQ:SCTY), and SunPower Corporation (NASDAQ:SPWR) are also companies with impressive backlogs. How do they compare?

| Company | Market Cap | P/E Ratio | Revenue Backlog |

| PowerSecure | $290 million | 66 | $206 million |

| SolarCity | $2.83 billion | n/a | $1.22 billion |

| SunPower | $2.5 billion | n/a | $541 million |

To be clear, these companies are very different. But they are similar in the sense that their mission is to save customers money on their power bills. SolarCity Corp (NASDAQ:SCTY) and SunPower Corporation (NASDAQ:SPWR) do this through solar leasing. PowerSecure does this through a range of solutions, such as energy-efficient lighting, generators for peak power hours, and renewable energy.

There is also a difference in the revenue backlog itself. SolarCity and SunPower’s recurring lease revenue is very long term — over the next 20 years. In contrast, PowerSecure International, Inc. (NASDAQ:POWR)’s backlog is mostly short term. All but $7 million is expected to come in the next couple of years, which is why the company has a forward P/E of just 18.

But even though this $206-million backlog is short term, it’s not going away. The company expects to increase the backlog next quarter. It’s also working to increase the long-term backlog with what at this time it’s just calling a “very large contract.”

SunPower Corporation (NASDAQ:SPWR) is expected to become profitable this year. Part of this is due to very favorable legislation and the tax code for solar companies. But another reason is because it manufactures its own solar panels while many other solar-leasing companies must purchase theirs. SunPower has a major opportunity with its new plant in Mexico, which could double its solar-panel production. But risks remain as this company has decent exposure in economically struggling Europe.

Though SolarCity Corp (NASDAQ:SCTY) grew quarterly revenue 21% to $30 million, it’s likely years away from profitability. All resources are being poured right back into the business — a-la-Amazon.com, Inc. (NASDAQ:AMZN) if you will — to create a powerhouse. Consider that the company’s total liabilities increased 10% in the most recent quarter, while total assets decreased 13%.

In SolarCity’s case, I’m not wishing to suggest that the company is in danger. I think it is building the business right. But near-term investors may become impatient waiting for profits to come, at which time they might not support the company’s $2.8 billion valuation.

Conclusion

PowerSecure International, Inc. (NASDAQ:POWR) has had a great ride so far. But the recent surge in earnings and stock price represent a solidly executed business strategy. As CEO Hinton continues to lead this company forward, I expect earnings to continue growing. It may be tempting to sell now to keep recent gains, but it seems the company has plenty of growth left in front of it.

Jon Quast has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Jon is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

The article This Power Company Has Impressive Backlog originally appeared on Fool.com and is written Jon Quast.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.