David Williams: Thanks so much for the time.

Todd Kelsey: Sure.

Operator: All right. Thank you so much. One moment for our next question please. All right. Our next question comes from the line of Jim Ricchiuti with Needham & Company. Your line is now open.

Jim Ricchiuti: Hi, good morning. You may have addressed this and I may have just missed it. I was on another call. But I was hoping — I heard some reference to the inventory correction in industrial and some of the subsectors spreading. And I was wondering, it sounds like you are on the margin a little bit more positive about what you are seeing in semi-cap. So where are you seeing some signs of potentially some softening in industrial?

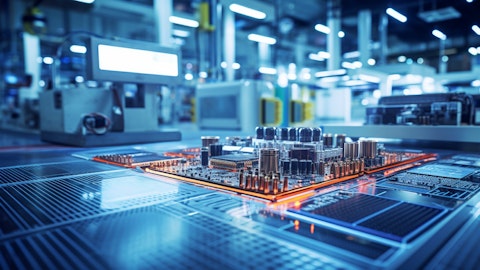

Todd Kelsey: Yes. I’ll jump in there, Jim, and provide how — provide some oversight — or overview as to how we’re looking at industrial. Yeah, you’re correct. Our commentary here in our script prepared remarks was pointing out some inventory reductions, creating some muted demand, specifically in industrial equipment, automation and electrification. We do see still incremental pushouts, say inside semi-cap, as we hear about fab delays, fab deployment delays. But on the whole, both within semi-cap and comms, we are seeing early incremental modest market improvement.

Jim Ricchiuti: Got it. And just may be a tougher one to answer, but just the broader correction that you are seeing in health care and even in some of the industrial markets where you have maybe seen the inventory challenges a little early on. Any sense as to when that correction those headwinds may begin to abate?

Pat Jermain: Yes. So maybe I’ll take a guide through each of our markets here, Jim and talk about where I think we’re at — at the moment. If we look at [A&D] (ph), continued strong, really across all subsectors within aerospace and defense, so that — would include security and commercial space, strong growth in each of those subsectors in fiscal ’24, and the outlook for ‘25 looks encouraging as well to –. If we go over to health care, that’s where we have seen the most severe inventory corrections. Now we believe we have hit the bottom there. So there is been stability in our forecast over the course of the past quarter, where previously we had been seeing degradation on a quarter-over-quarter basis. So there is signs we’ve hit the bottom there.

And then the question just becomes when do markets recover. So as we look to ’25, right now, we are projecting some strong growth within health care, but that is a result of program ramps, not market recovery at this point. So as markets recover, I think we could have a really strong growth projection at that time or growth outlook. And then looking at industrial, that is been the latest one to soften a bit. So over half the sector, I’d say, is on an upward trend right now that being semi-cap and our communications business. And the balance is seeing a bit of an inventory correction at this point – that is really kind of taking away from the growth that we are seeing in the other two subsectors.

Jim Ricchiuti: Got it. That’s helpful. Thank you.

Pat Jermain: Sure.

Operator: Okay. Thank you so much. One moment for our next question please. All right. Our next question comes from the line of Melissa Fairbanks with Raymond James & Associates. Your line is now open.

Melissa Fairbanks : Hey guys. Thanks so much. Maybe just a follow up Todd, on your comments on the health care business. We know you face some headwinds there for quite some time, first from supply constraints now maybe an overcorrection in terms of the buying patterns. But you actually slightly outperformed your expectations in March. Can you maybe give us an update on what you’re seeing in each product category there or any greater level of detail in terms of where the inventory corrections are coming? Or maybe what’s getting a little bit better?

Todd Kelsey: Yes. I think, I’ll pass it over to Oliver to give you a little color on that, Melissa.

Oliver Mihm: Yes, Melissa. Good morning. As we consider our Q2 performance, I would say that’s less subsector based and more customer specific. So we had a few customers that specifically increased their demand through the quarter. And then we had a couple of program ramps, both with new customers and existing customers that were essentially ahead, so moved a little bit faster than expected and those are the things that all contributed to the beat. The better performance, better work.

Melissa Fairbanks : Okay. Great. Excellent. So for my follow-up, and this might not be fair, but it seems like we have to talk about AI on every call. So in the past you’ve talked about deploying AI and machine learning in your own manufacturing processes. Some of your peers recently have been pretty outspoken about their own exposure to AI, either in the data center, some of the more industrial applications like power management. Can you remind us if you’ve got any direct exposure to this market outside of your own internal processes?

Oliver Mihm: Sure. Absolutely, Melissa. I think that — the most direct line that I can paint for you is if you contemplate AI and then build out associated with that and how that’s going to ripple through to semi-cap equipment, so that’s going to be something that we are going to participate heavily in. We also expect AI to drive continued innovation. So for instance, within health care, you could expect that to drive faster product innovation as they’ve developed for instance, on kind of making things up at algorithms to enable them to come up with patient outcomes more quickly and the innovation and device launching associated with that. We think that is something we would directly stand to gain from.

Melissa Fairbanks : Excellent. Thanks very much. That’s all for me for now.

Todd Kelsey: All right. Thanks, Melissa.

Operator: Thank you so much. One moment for our next question. Our next question comes from the line of Steven Fox with Fox Advisors LLC. Your line is now open.