Like everyone else, successful investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show successful investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what successful funds and billionaire investors think before doing extensive research on a stock. In this article, we take a closer look at PerkinElmer, Inc. (NYSE:PKI) from the perspective of those successful funds.

PerkinElmer, Inc. (NYSE:PKI) shareholders have witnessed a decrease in support from the world’s most successful money managers lately. There were 26 hedge funds in our database with PKI positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Braskem SA (ADR) (NYSE:BAK), Owens Corning (NYSE:OC), and VimpelCom Ltd (ADR) (NYSE:VIP) to gather more data points.

Follow Revvity Inc. (NYSE:RVTY)

Follow Revvity Inc. (NYSE:RVTY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Elena Pavlovich/Shutterstock.com

Now, we’re going to view the key action regarding PerkinElmer, Inc. (NYSE:PKI).

What does the smart money think about PerkinElmer, Inc. (NYSE:PKI)?

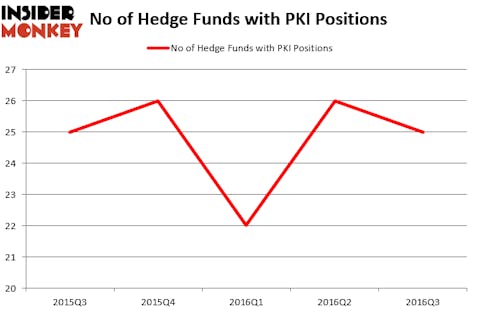

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PKI over the last 5 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, MFP Investors, led by Michael Price, holds the largest position in BMC Stock Holdings Inc (NASDAQ:BMCH). MFP Investors has a $60.6 million position in the stock, comprising 8.1% of its 13F portfolio. The second largest stake is held by Odey Asset Management Group, led by Crispin Odey, holding a $43.6 million position; 3.1% of its 13F portfolio is allocated to the stock. Remaining peers that hold long positions contain Richard S. Meisenberg’s ACK Asset Management, D. E. Shaw’s D E Shaw and Marc Lisker, Glenn Fuhrman and John Phelan’s MSDC Management. We should note that MFP Investors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually dumped their positions entirely. At the top of the heap, Arthur B Cohen and Joseph Healey’s Healthcor Management LP dumped the biggest position of all the hedgies followed by Insider Monkey, valued at an estimated $30.5 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund said goodbye to about $1.5 million worth of shares.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as PerkinElmer, Inc. (NYSE:PKI) but similarly valued. These stocks are Braskem SA (ADR) (NYSE:BAK), Owens Corning (NYSE:OC), and Steel Dynamics, Inc. (NASDAQ:STLD). This group of stocks’ market values are similar to PKI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAK | 8 | 45996 | 3 |

| OC | 35 | 1197532 | 1 |

| VIP | 22 | 253443 | 12 |

| STLD | 33 | 634258 | 2 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $533 million. That figure was $436 million in PKI’s case. Owens Corning (NYSE:OC) is the most popular stock in this table. On the other hand Braskem SA (ADR) (NYSE:BAK) is the least popular one with only 8 bullish hedge fund positions. PerkinElmer, Inc. (NYSE:PKI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OC might be a better candidate to consider taking a long position in.

Disclosure: None