Recently the coal market has operated under increasing pressure as natural gas usurps coal as the fuel of choice for energy production. The coal ETF Market Vectors Coal, which tracks miners, is down 32% in the last year alone and almost 60% over the last two years. Some 42.7% of this ETF is composed of US-based companies, and a majority are pure coal plays.

But before value investors go rushing in to scoop up stocks at these low prices, it would be wise to examine why the coal industry is in this position and what may resolve these tough times. Two major reasons exist for these current conditions.

Policy changes have discouraged the building of new coal-fired power plants. In March 2012, the U.S. Environmental Protection Agency set a higher standard for emissions of CO2 coming from new power plants. This would effectively require new coal-fired generating units to reduce uncontrolled emissions by approximately 50%.

Higher start-up costs for new plants are just one way of pursuing the elasticity of substitution from coal to natural gas. Over the past decades, a combination of policy and macro-economic fundamentals have demonstrated this substitution between oil and coal. Recently, natural gas has been thrown into the mix, hurting both oil but especially coal in terms of fuel-for-electricity generation.

Source: U.S. Energy Information Administration

Oil and natural gas are not exclusive to electricity generation, but coal is not so lucky. In fact, 92.6% of the coal that is mined here in the US is used for domestic energy production. In the future, due to controversial policies and decreasing utilization domestically, only the most efficient coal operations will survive.

Price competition

The wholesale price of fuel is critical in the decision to utilize either coal or natural gas for electricity generation. Over the last few years, sub $4 natural-gas prices have put that fuel in an advantageous pricing position. But those days may be over, as natural gas is currently trading at $4.30 and forecasts from the EIA suggest it will rise.

Coal’s prices are regional based on availability and transportation costs. While short-term fluctuations may not be enough to induce electricity generators to switch fuels, a long-term trend would certainly have that effect.

Recently the EIA released a detailed report showing the impact between coal and natural gas pricing in Pennsylvania. This sheds some light on where this transition would occur in regions with access to significant coal and natural gas deposits.

Source: U.S. EIA

This overlap has just hit this region. This could be the catalyst for increased utilization of coal-fired plants if managers believe the price of natural gas will increase.

Who will survive?

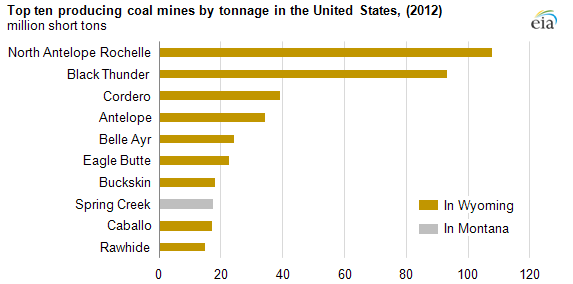

While coal is traditionally thought of as a commodity that comes from West Virginia and Kentucky, that should no longer be the case. Companies in Wyoming are exploiting the surface-mining potential, which is far more cost effective. Thick beds and large-scale operations make Wyoming’s sub-bituminous mines the lowest-cost mines in the United States.

Source: U.S. EIA

The most cost-efficient and largest mine operators should be the beneficiaries of better margins and economies of scale as tough times continue to plague this industry. So who will be the survivors?

Survivor #1

The North Antelope Rochelle Mine is owned and operated by Peabody Energy Corporation (NYSE:BTU). It has some of the most accessible deposits in the US and coal quality averages approximately 8,800 Btu/lb. and 0.2% sulfur, making North Antelope Rochelle coal the cleanest in the United States.

Coal seams measure between 60 feet and 80 feet thick and are located approximately 400 feet below the surface, making for an abundance of easily- accessible coal that drastically reduces extraction costs and improves margins.

Remaining coal reserves cover nearly 28,000 acres with about 2.4 billion tons of recoverable coal. Current extraction rates of 100 million tons a year yield a 20+ year life span distinguish it as the most productive mine in the US.