On the surface, Pacific Drilling SA (NYSE:PACD) looks like a typical growth company struggling to maintain profitability. After all, the company reported a loss per share of $0.21 in the second quarter (Q2), which was a big step back from the EPS of $0.01 it posted in the second quarter of last year. However, the company actually made a lot of progress in the quarter and could begin returning money to shareholders in the near future.

In Pacific Drilling SA (NYSE:PACD)’s Q2 earnings release, CEO Chris Beckett states, “The projected cash flows generated by our fleet, plus the recent financial transactions that provide us with low cost, long term financing, give our company additional confidence in terms of our ability to start distributing dividends as early as 2015, while continuing to grow the fleet.” While predictions of a dividend two years down the road should always be taken with a grain of salt, the company has positioned itself to potentially make it happen.

Digging into the numbers

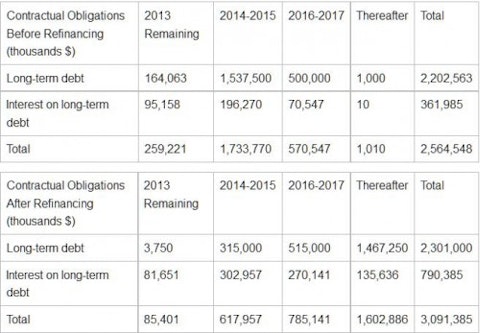

During the quarter, Pacific Drilling SA (NYSE:PACD) had total unusual charges of approximately $66.5 million as a result of its debt refinancing. Excluding the unusual charges, Pacific Drilling earned $0.10 per share, which is an improvement on its first quarter results. To understand the importance of the debt restructuring Pacific Drilling underwent, investors have to compare the company’s before and after debt situation. Check out the following tables.

The table on top is before the refinancing. While the company will be paying a higher total amount after the refinancing, most of the debt matures after year 2017. Furthermore, the debt maturity dates are more spread out. Before the refinancing, Pacific Drilling SA (NYSE:PACD) had a huge chunk, $1.4 billion, of debt maturing in year 2015. After the refinancing, the largest amount of debt maturity is $803 million for year 2018. So what does this mean for shareholders?

It’s more than just survival

By the end of year 2015, Pacific Drilling SA (NYSE:PACD) should have all eight of its drillships built and making money. The Pacific Zonda is projected to be the last of the eight drillships completed, and it is expected to be delivered in the first quarter of year 2015. This should translate to more cash generated from operations.

For year 2015, the company forecasts $600 million in operating cash flow and a cost of $336.4 million for its four ships currently being built. Thus, in year 2015, Pacific Drilling could generate around $264 million ($600 – $336) in free cash flow, which it could use to start returning money to shareholders or use to pay off debt. Positive free cash flow shows that a company has the potential to return money to shareholders because it measures the amount of cash the company generates from operations after the costs of investments in assets such as machinery have been deducted. It should be emphasized that these numbers are projecting two years down the road so they could be way different from the actual results.

Another way to roughly estimate 2015 free cash flow is to use 2013 as a benchmark. In the first half of year 2013, Pacific Drilling generated $106 million in operating cash flow. Thus, one can estimate $212 million for the full year. However, that’s with only four ships built and earning money so doubling that gives us a rough estimate of $424 million for eight ships. In addition, the day rates for the contracts awarded for the new rigs are higher than the day rates of the rigs currently operating so this estimate should be higher. Regardless, even with just $424 million in operating cash flow, the company could generate around $88 million ($424-$336) in free cash flow. Overall, Pacific Drilling looks poised to start generating positive free cash flow by 2015 and possibly begin returning money to shareholders.

Growth strategy

Pacific Drilling’s overall strategy is to focus exclusively on the ultra deepwater segment. This is different from the strategies used by other offshore drillers like industry giant ENSCO PLC (NYSE:ESV), who tries to meet demand at all water depths. In Q2, Ensco’s offshore drilling fleet consisted of 10 drillships, 19 semisubmersibles, and 46 jackups.

While the day rates for drillships are higher, there are also big markets for semisubmersibles and jackups. In Q2, ENSCO PLC (NYSE:ESV)’s jackup revenue grew 7% year over year to $404 million and accounted for about 32% of its revenue. The company expects another 14% increase sequentially in its jackup segment revenue in Q3. The advantage of ENSCO PLC (NYSE:ESV)’s approach is that it can tap into more markets and meet demand for different water depths and situations. Drillships and semisubmersible rigs are good for deepwater and ultra deepwater drilling, but shallow wells are drilled with jackups. Pacific Drilling’s approach doesn’t give it access to those other markets.

Still, as near shore oil fields are developed, there will be a natural trend to deeper water exploration, which should benefit Pacific Drilling. In addition, there is actually a ton of potential for growth in the industry. Since the average ocean depth is 14,000 feet and current technology only allows for drilling in water up to 12,000 feet deep, more than 50% of the oceans remain unexplored for oil. Also, oceans cover 71% of the Earth’s surface so the potential for industry growth is huge. Taking all these factors into account, Pacific Drilling looks positioned to generate a lot of value for shareholders.

The article 1 Driller Poised to Unleash Value originally appeared on Fool.com and is written by Alvin Gonzales.

Alvin Gonzales has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.