While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding PACCAR Inc (NASDAQ:PCAR) and see how the stock performed in comparison to hedge funds’ consensus picks.

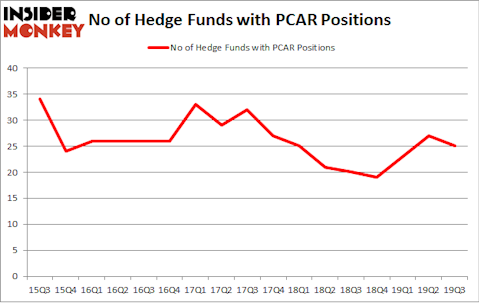

Is PACCAR Inc (NASDAQ:PCAR) a buy here? Prominent investors are getting less bullish. The number of long hedge fund bets shrunk by 2 in recent months. Our calculations also showed that PCAR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). PCAR was in 25 hedge funds’ portfolios at the end of the third quarter of 2019. There were 27 hedge funds in our database with PCAR holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

David E. Shaw of D.E. Shaw

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind we’re going to analyze the new hedge fund action regarding PACCAR Inc (NASDAQ:PCAR).

How have hedgies been trading PACCAR Inc (NASDAQ:PCAR)?

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards PCAR over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, D E Shaw held the most valuable stake in PACCAR Inc (NASDAQ:PCAR), which was worth $25.8 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $24.5 million worth of shares. GAMCO Investors, AQR Capital Management, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Algert Coldiron Investors allocated the biggest weight to PACCAR Inc (NASDAQ:PCAR), around 0.89% of its 13F portfolio. Impala Asset Management is also relatively very bullish on the stock, dishing out 0.67 percent of its 13F equity portfolio to PCAR.

Since PACCAR Inc (NASDAQ:PCAR) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few funds that decided to sell off their positions entirely by the end of the third quarter. It’s worth mentioning that Matthew Tewksbury’s Stevens Capital Management dumped the largest stake of the “upper crust” of funds tracked by Insider Monkey, worth close to $11 million in stock. Michael Kharitonov and Jon David McAuliffe’s fund, Voleon Capital, also dumped its stock, about $4.2 million worth. These transactions are interesting, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to PACCAR Inc (NASDAQ:PCAR). We will take a look at Xilinx, Inc. (NASDAQ:XLNX), Ball Corporation (NYSE:BLL), Baker Hughes, a GE company (NYSE:BHGE), and Agilent Technologies Inc. (NYSE:A). This group of stocks’ market values are similar to PCAR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XLNX | 38 | 1040263 | -1 |

| BLL | 28 | 556069 | 1 |

| BHGE | 33 | 954876 | 15 |

| A | 37 | 1857520 | -2 |

| Average | 34 | 1102182 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1102 million. That figure was $194 million in PCAR’s case. Xilinx, Inc. (NASDAQ:XLNX) is the most popular stock in this table. On the other hand Ball Corporation (NYSE:BLL) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks PACCAR Inc (NASDAQ:PCAR) is even less popular than BLL. Hedge funds clearly dropped the ball on PCAR as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on PCAR as the stock returned 45% in 2019 and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.