As you may have guessed by now, my rhetorical questions are leading to the point that there are a lot more moving parts to assessing this company. It’s a mix of strategic growth initiatives, exposure to construction and an aggressive emerging market initiative which is intended to transform the company over the next five years and get it on track to deliver its 4-6% top line growth target. Will it work?

Introducing Stanley Black & Decker, Inc. (NYSE:SWK) too

It’s been three years since the merger of these iconic brands and the company remains on track to deliver more synergies from the deal this year. It’s been a difficult five years for the company with its end markets obviously affected by weak end markets. However, going forward the key issue is the execution of its strategic growth initiative.

A look at its revenue by geographic region.

Of the major markets, Europe declined 2% organically last year and expectations are muted going forward. Europe was weak across all product ranges with Southern Europe the main culprit. As for the US it only recorded 1% organic growth last year but this number masks significant variance within the product range. Construction & Do It Yourself (CDIY) organic growth was up 7% in North America but was offset by weakness in Security and Industrial revenues. Emerging markets recorded an impressive 11% growth last year.

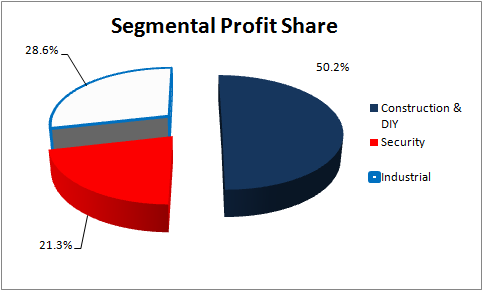

I’ve broken out segmental profits below.

Now considering that CDIY makes up over 50% of profits and North America represents 60% of CDIY revenues, it’s not hard to see that currently North American CDIY is its most important sales segment.

Indeed if you look at The Home Depot, Inc. (NYSE:HD) and Lowe’s Companies, Inc. (NYSE:LOW) recent results then all is well. Both companies reported strength across a broad range of product categories and the DIY market (traditionally more exposed to discretionary spending) is showing good growth in line with an improving economy. This bodes well for the sector. Consumer spending may be weak and the likes of Wal-Mart are feeling the pinch but the housing sector seems to be a kind of ‘sweet-spot’ in the economy. Indeed Home Depot is on record as believing this and that it can generate growth that isn’t necessarily correlated with GDP.

Strategic Growth Initiative

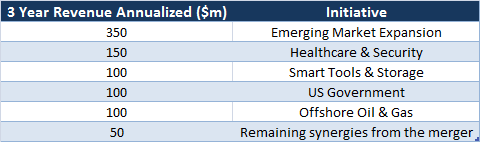

Having discussed the current situation, it’s time to look at its growth program. Essentially the idea is get to generate an extra $850m in run rate within three years through an initiative of investments in developing geographically and into new industry verticals.

The impressive thing about this plan is that it doesn’t appear to require much investment. Management forecasts $100m in operating expenses ($65m of it this year) and $50m of one time capital expenditures. With the company having generated $1bn in free cash flow in each of the last two years, it is hardly going to make a significant impact on its balance sheet.

The emerging market initiative revolves around low level investment in plants within emerging markets in order to capture future growth within these markets. This is fine but there are a few questions here. The plan involves changing its addressable markets with these regions. Previously its products were targeted at the top 10-20% of the market but management spoke about expanding this to 70% of the market by competing more with more moderately priced products. Naturally this involves a change of product range and brand recognition within these markets and this could prove a challenge. Moreover it relies on ongoing growth in emerging markets. A far from certain prospect.

The healthcare and security initiatives involve utilizing recent acquisitions and leveraging up by hiring sales executives in order to penetrate these verticals. Again it all makes sense but it does require execution within some difficult end markets. The smart tools and storage initiative includes exciting areas like MRO vending. The evidence from Fastenal Company (NASDAQ:FAST) and MSC Industrial Direct Co Inc (NYSE:MSM) is that MRO vending initiatives are working very well. Indeed both companies have this type of initiative as a center piece of their expansion plans.

Focusing on Fastenal Company (NASDAQ:FAST) for the moment, it has grown its share of sales from vending machines from less than 5% at the start of 2010 to more than 25% in the last quarter. Not only is this generating new growth but it also comes with higher margins and cash flow generation. It is a key part of the plan to increase working capital efficiency. In addition as Fastenal Company (NASDAQ:FAST) and MSC Industrial Direct Co Inc (NYSE:MSM) increase these kinds of activities it will lead to greater awareness and acceptance in the marketplace and therefore help out Stanley Black and Decker (NYSE:SWK) too.

As for the US Government and Oil & Gas plans, the idea is to penetrate markets that are relatively under represented for the company. Again this plan is fine in principle but it involves moving into one market that will (or rather should) face significant spending challenges over the next decade and another (oil & gas) that is subject to the vagaries of energy pricing.

Where Next For Stanley Black & Decker?

I’ve tried to give a balanced view point here because I actually find this stock compelling. I like the US construction exposure and even with the front end loading of its growth plan, its management is forecasting another $1bn in free cash flow for 2013. Company guidance is for $5.45-5.65 in earnings for this year. These metrics put it on a forward FCF/EV of around 6.5% and PE of 14.4x for 2013.

The evaluation is cheap if you believe in the long term program and can handle the caveats concerning them. Provided the economy holds up I think Stanley Black & Decker, Inc. (NYSE:SWK) can hit its objectives for this year and I would expect the stock to appreciate in line with the economy this year. Moreover the downside (of it not hitting its objectives) is mitigated because the growth program is not particularly expensive and the evaluation is attractive. Well worth a look.

The article Outlining This Construction Play’s Growth Opportunities originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.