As you may have guessed by now, my rhetorical questions are leading to the point that there are a lot more moving parts to assessing this company. It’s a mix of strategic growth initiatives, exposure to construction and an aggressive emerging market initiative which is intended to transform the company over the next five years and get it on track to deliver its 4-6% top line growth target. Will it work?

Introducing Stanley Black & Decker, Inc. (NYSE:SWK) too

It’s been three years since the merger of these iconic brands and the company remains on track to deliver more synergies from the deal this year. It’s been a difficult five years for the company with its end markets obviously affected by weak end markets. However, going forward the key issue is the execution of its strategic growth initiative.

A look at its revenue by geographic region.

Of the major markets, Europe declined 2% organically last year and expectations are muted going forward. Europe was weak across all product ranges with Southern Europe the main culprit. As for the US it only recorded 1% organic growth last year but this number masks significant variance within the product range. Construction & Do It Yourself (CDIY) organic growth was up 7% in North America but was offset by weakness in Security and Industrial revenues. Emerging markets recorded an impressive 11% growth last year.

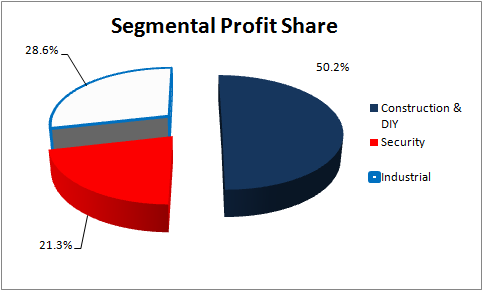

I’ve broken out segmental profits below.

Now considering that CDIY makes up over 50% of profits and North America represents 60% of CDIY revenues, it’s not hard to see that currently North American CDIY is its most important sales segment.

Indeed if you look at The Home Depot, Inc. (NYSE:HD) and Lowe’s Companies, Inc. (NYSE:LOW) recent results then all is well. Both companies reported strength across a broad range of product categories and the DIY market (traditionally more exposed to discretionary spending) is showing good growth in line with an improving economy. This bodes well for the sector. Consumer spending may be weak and the likes of Wal-Mart are feeling the pinch but the housing sector seems to be a kind of ‘sweet-spot’ in the economy. Indeed Home Depot is on record as believing this and that it can generate growth that isn’t necessarily correlated with GDP.

Strategic Growth Initiative

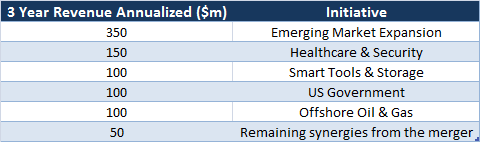

Having discussed the current situation, it’s time to look at its growth program. Essentially the idea is get to generate an extra $850m in run rate within three years through an initiative of investments in developing geographically and into new industry verticals.

The impressive thing about this plan is that it doesn’t appear to require much investment. Management forecasts $100m in operating expenses ($65m of it this year) and $50m of one time capital expenditures. With the company having generated $1bn in free cash flow in each of the last two years, it is hardly going to make a significant impact on its balance sheet.