At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Oppenheimer Holdings Inc. (NYSE:OPY).

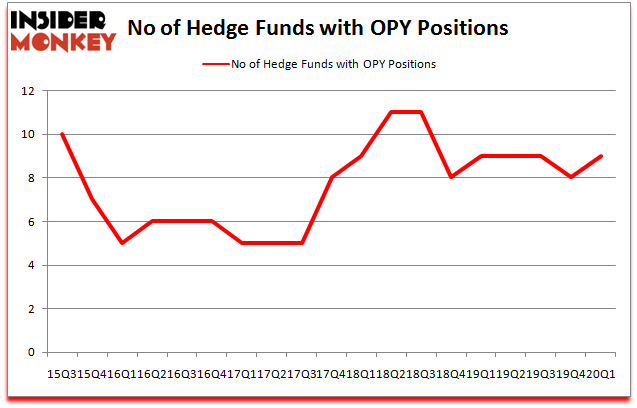

Oppenheimer Holdings Inc. (NYSE:OPY) was in 9 hedge funds’ portfolios at the end of the first quarter of 2020. OPY has experienced an increase in activity from the world’s largest hedge funds recently. There were 8 hedge funds in our database with OPY positions at the end of the previous quarter. Our calculations also showed that OPY isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to go over the latest hedge fund action regarding Oppenheimer Holdings Inc. (NYSE:OPY).

What have hedge funds been doing with Oppenheimer Holdings Inc. (NYSE:OPY)?

Heading into the second quarter of 2020, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the previous quarter. On the other hand, there were a total of 9 hedge funds with a bullish position in OPY a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Oppenheimer Holdings Inc. (NYSE:OPY), with a stake worth $9.9 million reported as of the end of September. Trailing Renaissance Technologies was Arrowstreet Capital, which amassed a stake valued at $3.5 million. AQR Capital Management, GLG Partners, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Winton Capital Management allocated the biggest weight to Oppenheimer Holdings Inc. (NYSE:OPY), around 0.02% of its 13F portfolio. Engineers Gate Manager is also relatively very bullish on the stock, setting aside 0.01 percent of its 13F equity portfolio to OPY.

As aggregate interest increased, key money managers have been driving this bullishness. Engineers Gate Manager, managed by Greg Eisner, created the biggest position in Oppenheimer Holdings Inc. (NYSE:OPY). Engineers Gate Manager had $0.2 million invested in the company at the end of the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Oppenheimer Holdings Inc. (NYSE:OPY) but similarly valued. We will take a look at Syros Pharmaceuticals, Inc. (NASDAQ:SYRS), Atlas Technical Consultants, Inc. (NASDAQ:ATCX), Insteel Industries Inc (NASDAQ:IIIN), and Jernigan Capital Inc (NYSE:JCAP). This group of stocks’ market caps are closest to OPY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYRS | 11 | 43061 | -2 |

| ATCX | 11 | 11058 | 0 |

| IIIN | 11 | 20786 | 5 |

| JCAP | 9 | 22597 | -2 |

| Average | 10.5 | 24376 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $22 million in OPY’s case. Syros Pharmaceuticals, Inc. (NASDAQ:SYRS) is the most popular stock in this table. On the other hand Jernigan Capital Inc (NYSE:JCAP) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Oppenheimer Holdings Inc. (NYSE:OPY) is even less popular than JCAP. Hedge funds dodged a bullet by taking a bearish stance towards OPY. Our calculations showed that the top 10 most popular hedge fund stocks returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.4% in 2020 through June 22nd but managed to beat the market by 15.9 percentage points. Unfortunately OPY wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was very bearish); OPY investors were disappointed as the stock returned 1.9% during the second quarter (through June 22nd) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Follow Oppenheimer Holdings Inc (NYSE:OPY)

Follow Oppenheimer Holdings Inc (NYSE:OPY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.