Some people built their fortunes by reinvesting dividends. My mother was one of them. For example, she parlayed a $2,500 investment in Bristol Myers Squibb Co. (NYSE:BMY) into $65,000 simply by reinvesting dividends into shares of the company over some 30 years. Then, when she needed the income, the cash dividends thrown off by the stock and her other holdings provided more than enough for her to live.

Many readers of my High-Yield Investing income advisory do the same thing. That’s the power you have with what I call Retirement Savings Stocks — stocks with high, dependable dividends that rise over time. Many of the best Retirement Savings Stocks are under the radar. But when you buy them, hold them, and reinvest the dividends, you wind up with one of the single most powerful wealth generators you could possibly have.

That’s not to say dividend reinvesting is for everyone or for all markets. The strategy magnifies your gains when stock prices are rising but also intensifies your losses when prices are falling.

But if you don’t need the income now, then participating in a dividend reinvestment plan (DRIP) or associated direct stock purchase plan (DSPP) can be a great way to build your nest-egg and its income-earning potential. These plans let you accumulate shares without excessive brokerage fees eating into your returns. DRIPs automatically use some or all of the cash dividends you receive to buy shares in the company. DSPPs allow you to buy additional shares direct from a company.

Broker or company DRIP?

Dividend reinvesting is a wealth-building strategy, but as with any strategy, you need to learn the ropes.

Once you decide that dividend reinvesting is for you, you need to make a decision: Do you use the broker or company DRIP?

Brokers offer free dividend reinvestment plans but also charge a commission each time you buy and sell the stock. Also, brokers generally don’t provide the direct stock purchase plans that companies make available if you participate in a company-sponsored DRIP.

The decision of whether to use your broker’s DRIP or a company plan depends, in part, on your investing style. If you invest small amounts on a regular basis, then a company-sponsored DRIP can help reduce costs. But if you buy and sell stocks in a large lump sum, without incurring much in brokerage fees, then your broker’s DRIP gives you more control over the timing and price of your trades.

The decision of whose plan to use also greatly depends on the type of plan the company offers. Not all company DRIPs are the same, so you need to read the fine print in the prospectus (which you can get on the company’s website or by phoning the company to request a copy). Some features in a company-sponsored DRIP and DSPP can make it worth your while to invest in a company plan even if you do invest in large lump sums.

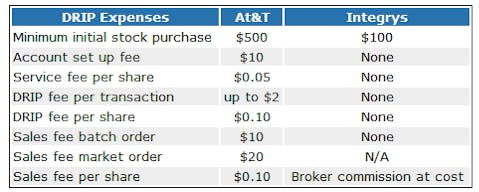

For example, below is a summary of electric utility Integrys Energy Group, Inc. (NYSE:TEG) DRIP plan, which is one of the best I’ve found, compared with AT&T Inc. (NYSE:T) DRIP.

Besides share ownership, a lot of other features in a company DRIP and DSPP can make it worth your while to invest in a specific company plan — or not. You can see, for example, how expensive AT&T’s dividend reinvestment plan is compared with Integrys Energy’s.

AT&T’s plan is clearly inferior. Once you’ve made the initial share purchase, AT&T will charge you $10 to set up your account, plus a service fee of $0.05 per share. In addition, each dividend reinvestment will incur a service fee of 5% of the amount reinvested, up to a maximum of $2.00, plus a transaction fee of $0.10 per share.

In contrast, Integrys charges no set up fee, no service fees, and no transactions fees for reinvesting dividends in shares of the company.

You can sell the shares you’ve acquired in the AT&T plan, but you will be charged a sales service fee of $20 for an intra-day market order or $10 for a weekly batch order, plus a broker commission of $0.10 per share in either case. For Integrys, there’s no sales fee and you’ll only bear the cost of what a broker charges for selling the shares in the open market.

In sum, Integrys provides an attractive option to your broker’s dividend reinvestment plan, but AT&T does not. And if you want to build a position gradually by buying additional shares over and above what you get from reinvesting dividends quarterly, the Integrys direct stock investment plan is definitely the way to go. There are no set up fees, no brokerage commissions, and no other charges. The minimum purchase is only $25 worth of stock at a time.

In contrast, you would do just as well to buy AT&T stock from your broker as you would direct from the company.

The best DRIPs on the market

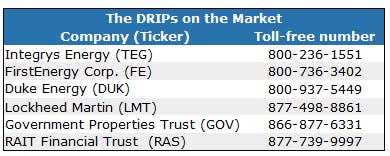

I found a half dozen companies that, like Integrys, carry 5% yields and also offer attractive no-fee DRIPs. Listed below are their names and a toll-free number you can call for additional information.

Risks to Consider: A good DRIP doesn’t guarantee good stock returns. It doesn’t ensure profit or protect you from loss any more than if you invested in the shares outside the plan. Moreover, the plans are not tax-free. Dividends reinvested in shares of the company are taxable at the same rate as dividends received in cash. Capital gains or losses on shares sold within the plan are treated the same way as shares sold outside the plan.

Action to Take –> Some of the companies on this list may make better investments than others. The list is just a starting point for further research. In fact, I’ve just released a report, “The 10 Best Retirement Savings Stocks for 2013,” that tells you more about Retirement Savings Stocks, including the names and ticker symbols of my top picks. Go here to learn more.

This article was originally written by Carla Pasternak, and posted on StreetAuthority.