Starting with just $900,000 in 1996, he has grown the assets of his fund, Greenlight Capital, to more than $6 billion. The fund has earned an average return of 22% since its launch, thanks to Einhorn’s prescient long and short stock picks. Compare this to the average hedge fund and Greenlight stands heads and shoulders above.

Einhorn is a noted activist investor who believes in the value approach for stock picking. Believe it or not, his investment philosophy is quite simple: He operates with the idea that a company’sintrinsic value will achieve consistent absolute returns for its investors. He’s really made his name on some high-profile short sales, betting against the likes of Lehman Brothers prior to the financial market crash of 2008 and Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR), which had increased more than tenfold within two years and plunged by 50% within one month after the he announced his short position.

Einhorn is also a world-class poker player. While poker and finance often go hand in hand with many market professionals, few have reached the skill level of Einhorn. This summer, he took third place in the World Series of Poker with a $4.35 million win, which was donated to Boston-based City Year, a nonprofit education organization for young people.

Clearly, investors should be following Einhorn’s footsteps and watching his holdings with an eagle eye. Taking a closer look at Greenlight’s current holdings, one stock with powerful upside potential stands out.

Einhorn owns nearly 11 million shares of Einstein Noah Restaurant Group, Inc. (NASDAQ:BAGL), a stock with a very appropriate ticker symbol as it specializes in bagel specialty restaurants. Einstein Noah was founded in 1992 and currently operates close to 800 bagel shops in 39 states.

The stock is clearly one of Einhorn’s favorites, as he has maintained this holding for more than eight quarters. The company makes up almost 3% of Greenlight’s stock portfolio. Put another way, Greenlight owns 63% of the company’s outstanding shares. Einstein Noah is also one of Einhorn’s top dividend-paying holdings, with an annualized dividend of 50 cents per share, generating a yield of about 3%.

During the past several days, shares of the bagel maker have sold off sharply. The selloff was triggered by a company forecast of less-than-expected third-quarter results combined with a potential restructuring of debt, merger or sale.

The company is anticipating earnings of $3.4 million on revenue of $105.5 million. These numbers miss the average $3.6 million in profit and $108.3 million in revenue analysts had projected. But the company is considering strategic actions to maximize shareholder wealth. A special dividend announcement, a debt restructuring and/or an outright sale or merger are all on the table right now.

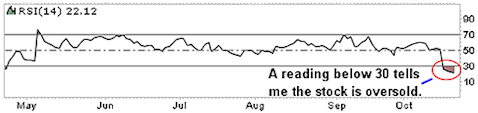

Technically, the recent selloff has pushed shares into oversold territory, with the Relative Strength Index (RSI) plunging to 23. The RSI helps investors see a top or bottom for any given stock. Any reading below 30 is considered to be oversold, which means that the selling pressure is in the process of wearing itself out. This is when technical investors should start looking for entry points on the long side. The lower price can also act as a catalyst to create a superior opportunity for dividend investors to earn a higher yield.

This great entry-point opportunity, combined with Einhorn’s heavy stake on the company, the dividend yield, the possible special dividend and potential merger that could unlock shareholder value make Einstein Noah Restaurant Group a great potential addition to anyone’s portfolio.

Risks to Consider: It’s critical to keep in mind that just because a major and successful money managerowns shares in a company, it is not a guarantee it can’t drop in value. While this type of ownership is a powerful bullish signal, it is not foolproof by any means. The big guys can and do lose money, as no one is larger than the market itself.

In addition, with all the potential changes taking place in the company, there are many unknowns right now.

Action to Take –> I firmly think the odds lay on the bullish side with Einstein Noah Restaurant Group. However, at the same time, I don’t want to catch a falling knife should the weakness continue. My plan, right now, is to wait for a bounce above the 200-day simple moving averagein the $16 range prior to buying. Once long, I will use the 200-day simple moving average as the stop level, closing the trade on a daily close below it.

This article was originally written by Dave Goodboy, and posted on StreetAuthority.