Unidentified Analyst: Okay, great. That’s it from me. Thanks guys.

Operator: Your next question comes from David Smith from Pickering Energy Partners. Please go ahead.

Rod Larson: Good morning, David.

David Smith: Hey good morning, good morning. The very impressive order intake for manufactured products. I was wondering if you could give any color there if there were some big lumpy orders? And maybe just a quick update on what percentage of the backlog for that segment is nonenergy?

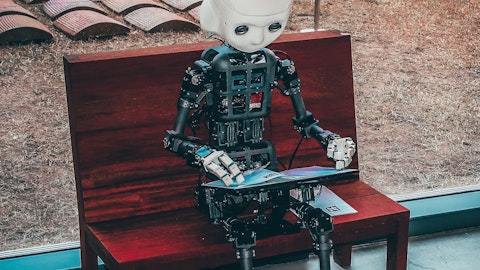

Alan Curtis: Yes, I think part of the order intake has certainly been widespread. There’s not really a single order which we’ve alluded to in the past of some of the lumpiness that can come in. These have been a pretty good fluent stream of midsized orders I would say across various plant sites. And while we haven’t disclosed the orders in the nonenergy side, David, I mean Rod just kind of alluded to, we did see some nice orders in the third quarter to add to the backlog in the mobile robotics platform, so we’ve more than doubled the base order at this point in time that will certainly build a nice platform for manufacturing next year on these autonomous mobile forklifts. So order adoption is certainly picking up across the board within that business unit.

David Smith: That’s good color and I appreciate it. I guess kind of related…

Alan Curtis: David, one of the things that I’d like to just add is, as I look at that backlog and what’s important to me is we do still anticipate some additional awards in the manufactured products. But when you get it across all the plant sites and I’ve lived in this business, it’s more meaningful than just getting one big award because we talk about absorption all the time at these plants and by being able to feed every plant that work it is something that we’re always looking at, so it’s well spread through the organization.

David Smith: I appreciate that color. And I just want to make sure just to refresh my memory, the DPR [ph] System Alert that would be coming through OPG correct?

Alan Curtis: Correct. It’s kind of the extension to the existing contract with an option for Petrobras to add an additional system, which at this point we don’t believe they’re going to take, but it’s an option they do hold through December of this year. But it’s been good work for us. In fact Brazil has been a strong growth area for us throughout many of our businesses this year.

David Smith: Yes, absolutely. And last one if I may. Just for calibration, could you please elaborate on the impact that the commercial dispute resolution had for the OPG margins in third quarter?

Alan Curtis: I don’t think we put a number out there on that, but it’s really an element of what we had in Q1Q2 where we’ve taken some level of reserves and were able to successfully negotiate it with the customer and in the third quarter. So within the year, the pots, right. So the margins for the year are what I would say reflective of our true operations. We just have a little bit of that I’ll say lumpiness of working through this with the customer within the quarter.

David Smith: Makes perfect sense. I appreciate it and will turn it back. Thank you.

Alan Curtis: Thank you.

Operator: Thank you. And there are no, pardon me, and there are no further questions at this time. I will turn the call back over to Rod Larson for final comments.

Rod Larson: All right. Well, since there are no more questions, I’ll just wrap up by thanking everybody for joining the call and this concludes our third quarter 2023 conference call. Thank you.

Operator: Ladies and gentlemen, this concludes your conference call for today. We thank you for joining and you may now disconnect your lines. Thank you.

Follow Oceaneering International Inc (NYSE:OII)

Follow Oceaneering International Inc (NYSE:OII)

Receive real-time insider trading and news alerts