We came across a bullish thesis on Novo Nordisk A/S (NVO) on Substack by Long-Term Pick. In this article, we will summarize the bulls’ thesis on NVO. Novo Nordisk A/S (NVO)’s share was trading at $81.79 as of Feb 12th. NVO’s trailing and forward P/E were 26.01 and 21.51 respectively according to Yahoo Finance.

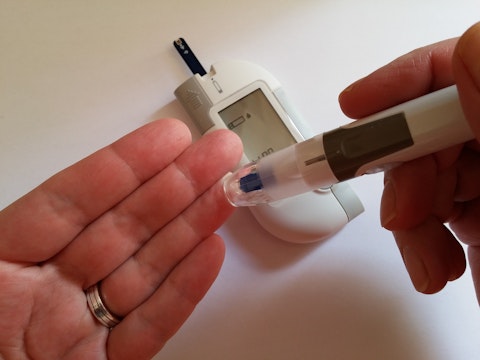

Pixabay/Public Domain

Novo Nordisk (NVO) remains a dominant force in diabetes and obesity treatments, yet the stock is currently trading below its fair value. Despite a recent decline following disappointing trial results for its new weight-loss drug, CagriSema, and weaker-than-expected third-quarter sales, the company continues to post strong growth. Novo Nordisk reported a 26% increase in both sales and operating profit for 2024, reflecting its continued expansion in diabetes and obesity care. The company now serves over 45 million patients globally, with obesity care sales surging by 57% due to significant growth in North America and international markets. Novo Nordisk also reinforced its leadership in the GLP-1 market, maintaining its dominant position with nearly two-thirds of all GLP-1 patients using its treatments.

A key milestone for the company was the acquisition of Catalent sites, which expands its global fill-and-finish capabilities and ensures a more robust supply chain for future market demand. However, despite these strong operational results, certain financial and environmental challenges have weighed on investor sentiment. The company saw a 23% rise in carbon emissions due to increased production volumes and capital investments. R&D expenses surged by 48%, driven by higher clinical trial activity and impairments on intangible assets. Additionally, the company reported a net financial loss of DKK1.1 billion, primarily due to losses on non-hedged currencies. The effective tax rate also increased to 20.6%, up from 20.1% in 2023. Moreover, free cash flow turned negative at minus DKK14.7 billion, largely due to heavy capital expenditures and the Catalent acquisition.

Despite these challenges, Novo Nordisk remains well-positioned for long-term growth. The market reaction to the CagriSema trial results appears overdone, as the company’s core diabetes and obesity business continues to thrive. Management’s strategic investments in production capacity and supply chain expansion will support future growth, and the company retains pricing power and market leadership in its key segments. The fair price estimate for the stock is $132, reflecting the company’s resilience and ongoing growth in the obesity care sector. With its strong fundamentals and continued expansion, the current stock price offers an attractive entry point. Long-term investors may see significant upside potential as the market processes recent earnings and the company executes its growth strategy.

Novo Nordisk A/S (NVO) is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 61 hedge fund portfolios held NVO at the end of the third quarter which was 67 in the previous quarter. While we acknowledge the risk and potential of NVO as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than NVO but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.