We came across a bullish thesis on Novo Nordisk A/S (NVO) on Long-Term Pick’s Substack by Dan. In this article, we will summarize the bulls’ thesis on NVO. Novo Nordisk A/S (NVO)’s share was trading at $106.13 as of Nov 27th. NVO’s trailing and forward P/E were 35.59 and 27.25 respectively according to Yahoo Finance.

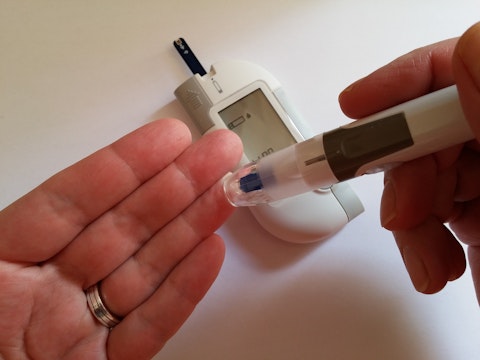

Pixabay/Public Domain

Novo Nordisk is a global leader in healthcare, renowned for its groundbreaking innovations in diabetes and obesity treatment, notably through products like Ozempic and Wegovy. Under the leadership of CEO Lars Fruergaard Jørgensen, the company has delivered consistent growth by expanding its therapeutic offerings and driving operational efficiency. In the first nine months of 2024, Novo Nordisk reported revenue of DKK 204.7 billion, marking a 23% year-over-year increase, fueled by the success of its GLP-1 therapies. These therapies have cemented Novo Nordisk’s position as the leader in diabetes care with a commanding 34% global market share. The recent launch of Wegovy further highlights the company’s ability to address emerging challenges such as obesity, a growing global health concern.

Financially, Novo Nordisk exhibits remarkable strength with high profit margins, disciplined capital allocation, and a robust balance sheet characterized by low debt. This financial stability enables the company to reward shareholders generously—distributing DKK 61 billion in dividends and share buybacks in 2023—while reinvesting in innovation to sustain long-term growth. The company’s valuation appears particularly compelling, with its price-to-earnings-growth (PEG) ratio at a decade low, signaling an attractive entry point for investors. Although minor setbacks, such as underwhelming trial results for its obesity drug Monlunabant and slightly below-forecast sales, have caused short-term fluctuations, the company’s fundamentals and growth strategy remain strong, making it a standout investment in the healthcare sector.

Novo Nordisk operates through two primary segments: Diabetes and Obesity Care, and Rare Diseases, both integral to its success. Its strategic pivot from traditional insulin therapies to GLP-1 receptor agonists—now accounting for 70% of its revenue—showcases its ability to innovate and adapt. This platform is being extended to tackle related conditions, including cardiovascular diseases, metabolic-associated fatty liver disease, and Alzheimer’s, broadening its market potential. The company has bolstered its portfolio through acquisitions like Inversago Pharma and Dicerna Pharmaceuticals, which enhance its capabilities in obesity and cardiometabolic treatments. These efforts underscore Novo Nordisk’s commitment to maintaining its leadership in addressing chronic diseases.

The company’s economic moat is underpinned by its dominant GLP-1 market position, efficient manufacturing processes, and unparalleled reputation for innovation. Its scale and size create significant barriers for potential competitors, even as pricing pressures emerge in key markets like the U.S. and China. Novo Nordisk actively addresses these challenges, engaging with U.S. lawmakers on drug pricing to balance patient access and profitability. This proactive approach reinforces its long-term sustainability in a competitive landscape while bolstering its market position.

Novo Nordisk’s capacity to generate substantial free cash flow enables it to invest in expanding production facilities to meet the rising demand for GLP-1 therapies. These investments also aim to address supply chain constraints that have occasionally dampened growth. The company’s diversification into less-publicized but crucial segments like hemophilia care and growth hormone therapies adds resilience to its portfolio, helping mitigate risks tied to pricing and competition in its core markets. This diversified approach strengthens its position as a leader in the broader healthcare space.

Novo Nordisk is well-positioned for sustained success, driven by its innovative pipeline, operational excellence, and strategic investments. Its leadership in diabetes and obesity care and a promising array of next-generation therapies offer a strong foundation for continued growth. Despite recent stock price challenges, the company’s financial health, clear vision, and market dominance outweigh short-term obstacles. With a P/E ratio of 34.2x—below its five-year average—Novo Nordisk offers value relative to its growth prospects. The forward P/E of 27.4x and a PEG ratio of 1.35, at a 10-year low, further highlight its undervaluation. With a fair price estimate of $124.92, representing a 16.68% upside from the current price of $104.09, Novo Nordisk presents a compelling investment opportunity for long-term investors.

Novo Nordisk A/S (NVO) is not on our list of the 31 Most Popular Stocks Among Hedge Funds. As per our database, 61 hedge fund portfolios held NVO at the end of the third quarter which was 67 in the previous quarter. While we acknowledge the risk and potential of NVO as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than NVO but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.