By 2015, it is expected that the Federal Aviation Administration will begin to allow commercial unmanned flying vehicles, commonly know as drones, to operate within the U.S. airspace. That means there is potential for many publicly-traded companies to boost their revenues as drones take to the skies for security, logistical, and information-gathering purposes.

Right now, private drone operations are limited to hobbyists that can operate with a ceiling of 400 feet. But that’s going to change in 2015, and it’s going to create a whole new industry. With that being said, let’s take a look at some of the companies whose stocks could be great investments for the future of drone technology.

The twenty-year veterans

Defense contractor Northrop Grumman Corporation (NYSE:NOC) is one of the biggest providers of unmanned systems for the United States as well as governments around the world. The company’s RQ-4 Global Hawk has been flying since 1998. The newer X-47B and MQ-4C Triton are surveillance and reconnaissance vehicles that are a part of the U.S. government’s long-term plans.

This means that Northrop Grumman Corporation (NYSE:NOC), despite the budget reductions taking place within the Defense Department, should be able to capitalize on its experience. Indeed, the company has seen no significant revenue drop quarter over quarter, and it should be able to drum up new contracts in the growing drone market even as older ones expire. The company has been working on unmanned systems for almost twenty years at this point; therefore, anyone who wants to get involved in drone systems will want to work with them.

The company looking for another home run

Yep, Google Inc (NASDAQ:GOOG) is on this list. Seems strange? Well, given the fact that Google’s venture capital arm invested in Airware, which is software for controlling smaller-scale drones, it isn’t all that weird. Google Inc (NASDAQ:GOOG) has a vested interest in drones — whether they are in the sky, on the road in the form of a driverless car system or in developing advanced maps with the aid of some unmanned help.

Think about Google Inc (NASDAQ:GOOG)’s investment in Airware the same way that the company approached Android. Google wants to help build platforms that customers will use, which they will then monetize. Android has had 750 million total activations so far – and the more users, the more ways to monetize. This will happen with drone technology and Google Inc (NASDAQ:GOOG)will find ways to profit. They can’t rely on advertising alone — if the company wants to continue making huge profits every quarter they’ll need another home run business.

Drones with blades

A dominating force in small aircraft with Bell Helicopters and the Cessna series of small airplanes, Textron Inc. (NYSE:TXT) is uniquely prepared for the coming onslaught of drones filling the skies. It already has a ton of aviation experience that it can pair with a burgeoning drone business. Its revenue numbers are down a bit, and it is surely looking into developing commercial unmanned vehicles.

Textron purchased AAI Corp., the manufacturer of the Shadow reconnaissance vehicle, in 2007. The Shadow is heavily in use by the U.S. military, with over 100 of them currently in service. And Textron is planning on using its expertise in helicopter technology to bring enhanced mobility to drones. The company has develop a modified Shadow with a rotor that allows the vehicle to make vertical takeoffs. This would be very useful in the commercial market because it does not require runway space to operate.

Saving money with drones

Fred Smith, CEO of FedEx Corporation (NYSE:FDX), has gone on record saying that drones will be a part of his company’s business strategy. “Unmanned cargo freighters have lots of advantages for FedEx: safer, cheaper, and much larger capacity.” Being able to use unmanned vehicles, FedEx will be able to reduce its quarterly $10 billion operating expenses and increase its margins.

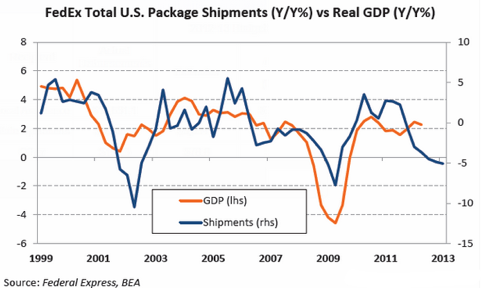

FedEx is a logistics company, and Smith’s early foray into the industry will reap major benefits for the company. This will come in the form of new services drones can provide that have not even been imagined yet. FedEx will be able to guide leaner supply chain operations and make money in the process. Package shipments, and thus revenue, rise and fall with the economy, and a leaner FedEx is a meaner money-making FedEx.

Bottom line

Look for FedEx to make leaps in drone technology early. Its business is ready-made for the FAA decision to allow commercial drones. Google Inc (NASDAQ:GOOG) wants to be involved in drones, but its hard to make the connection yet how they will make money. They are looking for ideas to keep growing, and drone tech is a part of that search. Don’t bet on them getting in on the game early.

Both Textron and Northrop Grumman Corporation (NYSE:NOC) are prepared for large-scale commercial drone deployments. These companies are looking for a boost in revenue and diversification outside of government contracts. They both face stiff competition from smaller and more nimble upstarts in the industry, but having scale in a market like this will be helpful. They both have experience and connections working with the government, which might be important early on as the FAA tweaks its regulations based on public perception.

Daniel Cawrey has no position in any stocks mentioned. The Motley Fool recommends FedEx and Google. The Motley Fool owns shares of Google, Northrop Grumman, and Textron.

The article The Best Investments for the Coming Drone Craze originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.