Nike’s Business Today

NIKE, Inc. (NYSE:NKE) is by far the world’s largest athletic shoe manufacture, with an estimated market share of about 50%. The company also sells a wide range of apparel under its own brand, and affiliated brands such as Converse and Hurley. While Nike’s dominance of the shoe business may be about as strong as it can get, the company does have a lot of growth potential left in the apparel business.

The global market for athletic apparel is estimated to be around $100 billion annually, much larger than the $20 billion athletic shoe market. With about 50% of the athletic footwear market, assume that about $10 billion of Nike’s annual sales come from shoes. If the rest of the company’s sales (about $14 billion) come from apparel, that means that Nike only has a 14% market share in the athletic apparel business, a number I feel is definitely below NIKE, Inc. (NYSE:NKE)’s potential.

Too Expensive?

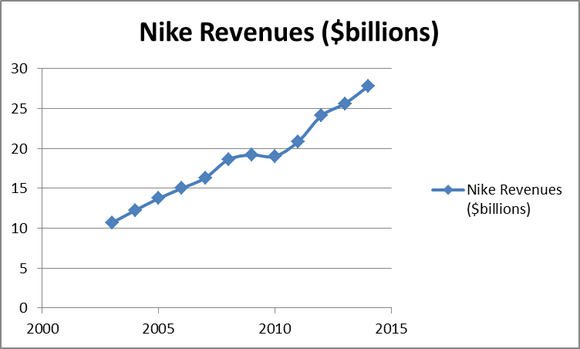

At about 24 times TTM earnings, I have hear the case made that NIKE, Inc. (NYSE:NKE) is expensive at the current share price. With revenues expected to reach almost $28 billion in fiscal year 2014 (which began this month), I think the continued growth justifies the valuation.

When Nike reports FY 2013 results on June 24, it is expected to announce earnings of $2.68 per share, and the consensus of analysts that follow the company expects this to increase to $3.06 and $3.51 in 2015 and 2016, respectively. This represents a 3-year average earnings growth rate of 14%, which more than justifies the current P/E, especially considering that Nike had about $3.5 billion in net cash on its balance sheet as of last June, which I expect to have risen since then, as the company has sold its Umbro and Cole Haan brands since then.

Other Ways to Play: The “Up-and-comers” and Retailers

There are a few other viable investments in the sector, including high growth up-and-comers like Under Armour Inc (NYSE:UA) and the stores that sell athletic footwear and apparel such as Foot Locker, Inc. (NYSE:FL).

Under Armour: The Next Nike?

Under Armour Inc (NYSE:UA) has been one of my favorite long-term prospects for some time, and I believe that the company has only begun to tap into its true potential. Under Armour Inc (NYSE:UA) is the clear leader in the synthetic performance apparel market, with a market share of about 60%. Where the real potential lies is in the $12 billion “active use” sportswear market, which the company recently entered with its first cotton performance apparel in 2011. If Under Armour can replicate its success in this new venture, it could prove very lucrative for Under Armour shareholders. This is not to mention the potential should Under Armour Inc (NYSE:UA) ever delve into the $58 billion “active wear” market, which includes casual, everyday wear in addition to athletic clothing.